Managed Services

We manage critical operations for leading financial services firms

We combine skilled talent, best-in-class process, and scalable technology to deliver operational efficiencies and cost savings to our clients.

Our Managed Services teams runs KYC refresh, trade surveillance, transaction monitoring, credit loan review, portfolio management, and sanctions/negative news screening.

Delivering Value at Every Step

Service Delivery Centers

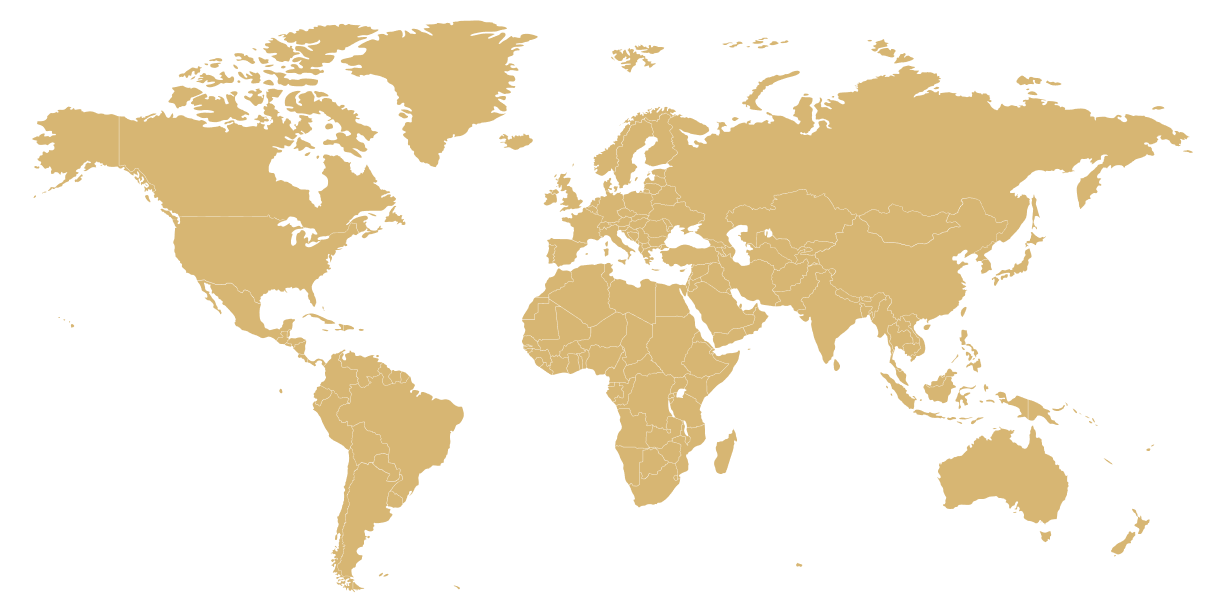

Treliant’s Service Delivery Centers (SDCs) offer high quality, experienced project teams, staff augmentation, and business process outsourcing from our sites in the United States, Northern Ireland, Poland, India, and the Philippines.

Our Services

Outsourced KYC

Outsourced KYC

We support our clients in all aspects of the KYC lifecycle, with cost-effective services for onboarding, periodic refresh, or remediation

Fraud Alerts

Fraud Alerts

Our fraud team delivers efficiency to your operational processes, including activity monitoring, alert reviewing, and SAR drafting

Outsourced Transaction Monitoring

Outsourced Transaction Monitoring

We provide skilled, cost-effective teams to run transaction monitoring, from alert reviews to case investigations and SAR drafting

Trade Surveillance

Trade Surveillance

Our trade surveillance experts provide alert review and disposition across all financial instruments and abusive behaviors

Sanctions, Watchlist, and Adverse Media Screening and Monitoring

Sanctions, Watchlist, and Adverse Media Screening and Monitoring

Static data and real-time sanctions screening alert reviews, with 24/7 coverage from our Service Delivery Centers, and ongoing watchlist monitoring

Skilled Teams in Dedicated, Secure Facilities

Our SDCs are located in regions with abundances of high-quality, cost-effective talent. All locations are secure, dedicated office spaces with high-speed access to our clients’ systems.

Scalable

A cost-effective and scalable resource model which can quickly flex to support seasonal or other variations in business demand, without impacting your headcount.

Continuous Improvement

We define, document, and refine repeatable processes to support efficient, predictable service delivery.