Prudential Regulatory Authority Releases PS6/23 – Model Risk Management Principles for Banks

- Source: bankofengland.co.uk

Treliant Takeaway:

Treliant helps banks and financial institutions design and implement the complete lifecycle of model risk management. Treliant can help firms with

- Carrying out self-assessment reviews of existing model risk management framework

- Design, develop and implement the relevant model risk management policy and governance frameworks

- Prepare supervisory approval submissions

- Audit the MRM framework

- Design and implement risk and controls for the management and regulators

Highlights:

Prudential Regulation Authority’s (PRA) has proposed expectations regarding banks’ management of model risk in line with the supervisory expectations of other countries such as SR 11-7 in the United States.

PRA has proposed the following 5 principles that are aimed at covering all elements of the model lifecycle.

- Principle 1 – Model identification and model risk classification – Firms need to establish model definition that outlines the scope for MRM (model risk management), model inventory and risk based tiering approach to categorizing models.

- Principle 2 – Governance – Emphasis on strong board governance oversight to promote MRM culture through model risk appetite

- Principle 3 – Model development, implementation and use – Focus on robust model development process with appropriate standards for model design and implementation, model selection and model performance measurement through ongoing regular testing of data, model assumptions etc.,

- Principle 4 – Independent model validation – Spotlight on independent and effective challenge to model development and use to ensure the models are fit for purpose

- Principle 5 – Model risk mitigants – Need for established policies and procedures for independent review of post model adjustments

What Next?

- This consultation closes on 21-Oct-2022. All responses including comments or enquiries need to be submitted to CP6_22@bankofengland.co.uk The implementation date would be set 12 months following the publication of the final rule.

- Initiate Self-Assessment – All firms applying the proposed MRM principles are required to undertake an initial self-assessment against the proposals and where needed, prepare remediation plans to address any identified shortcomings.

- Annual Self-Assessment – The self-assessments should be updated annually thereafter and all remediation plans should be reviewed and updated on a regular basis. Firms’ boards should be updated on the remediation progress on a regular basis

- Board level accountability – The PRA requires the board appointed individual for MRM be held accountable and responsible for ensuring all remediation plans are in place with clear ownership for any actions needed

- Simpler Regime – Firms that qualify as a simpler – regime firm are required to apply Principle 1 in full with an expectation that it would focus on the basic elements of Principle 2, Governance.

- Financial Reporting to Audit Committee – PRA proposes that firms report on the effectiveness of MRM for financial reporting to their audit committee on a regular basis, and at least annually, and ensure that this report is available on a timely basis, to facilitate effective audit planning.

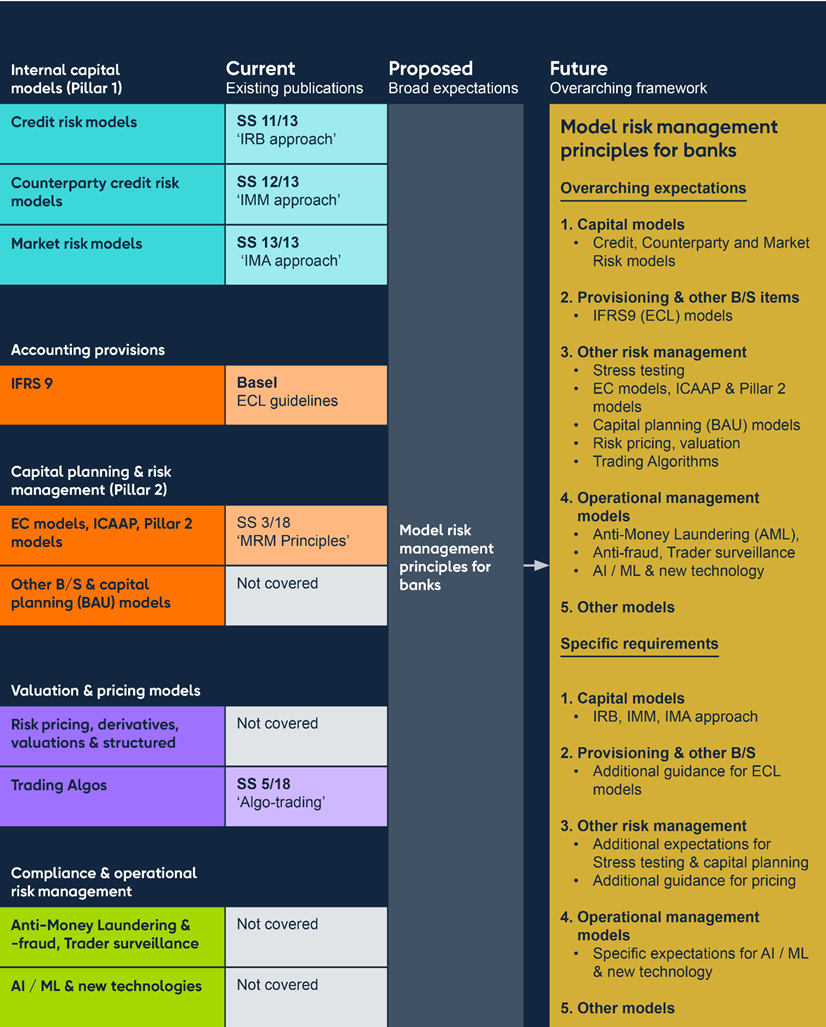

Future Roadmap – It is worth noting that the PRA’s proposals are intended to complement, not supersede existing requirements and supervisory expectations for various model risk types as outlined below.

- Internal Ratings Based (IRB) approach

- Counterparty credit risk

- Market Risk

- Stress Testing

- Credit risk and accounting for expected credit losses

In the future, PRA may seek to rationalize existing references to MRM under a single overarching policy framework, where the proposed broad expectations would be applicable to all model and risk types and where specific requirements (such as IRB model requirements) and any more detailed expectations in relation to specific model types.

Ready to Talk?

We work with you to understand your needs, so we can tailor our approach to your engagement. Learn more when you connect with our team.