This Year, Half as Many Metro Areas are Affordable to Low-Income Homebuyers as Last Year

- Source: www.jchs.harvard.edu

Treliant Takeaway:

Treliant knows fair lending and fair housing. If your financial services institution needs assistance with assessing your fair lending, affordable lending, or CRA risks embedded in your mortgage lending processes, we can help.

Highlights:

The Joint Center for Housing Studies of Harvard University[1] conducted an analysis of the top 100 U.S. metro areas to determine the affordability of housing for households with income levels between 50% – 80% of AMI, comparing 2021 data to 2020 data. They discovered home ownership affordability declined by more than 47 percent year over year.

Change in Housing Affordability 2020 – 2021

|

Income Level |

Year 2020 % of Households able to Afford a Home Purchase | Year 2021 % of Households able to Afford a Home Purchase | Difference in Homeownership Affordability |

| 50-80% of MSA median family income | 39% | 20% | 47.5% |

Some of the issues related to affordable homeownership have changed during the almost two (2) year COVID-19 pandemic. Low interest rates, supply chain disruptions, and a hot homebuying market have pushed home costs higher. This is especially true for low-to-moderate income[2] (“LMI”) households that have historically faced such challenges as:

- Lack of funds for down payment and closing costs,

- Stable employment histories

- Acceptable debt-to-income ratios,

- Sufficient credit histories and experience,

- Proof of income (W2’s, tax returns), and

- Meeting minimum credit score requirements.

While the disparity in homeownership rates between the low-to-moderate and middle-upper income levels have always been a source of concern for policymakers, new COVID-19 related issues related to financing affordable homeownership have risen. Today these households face additional issues such as economic insecurity, business closures, loss of employment, the lack of available housing stock, and the rise in housing costs in suburban markets. What has been called “the mass exodus of millennials from major cities”[3] has driven up home prices and made what was formerly an affordable home purchase option difficult to obtainable for LMI homebuyers. An analysis conducted by the Federal Reserve Bank[4] in July 2021 reported “that the new demand in housing has exceeded even pre-pandemic levels of supply, and the gap is too large to be realistically filled by new construction in the short term.”

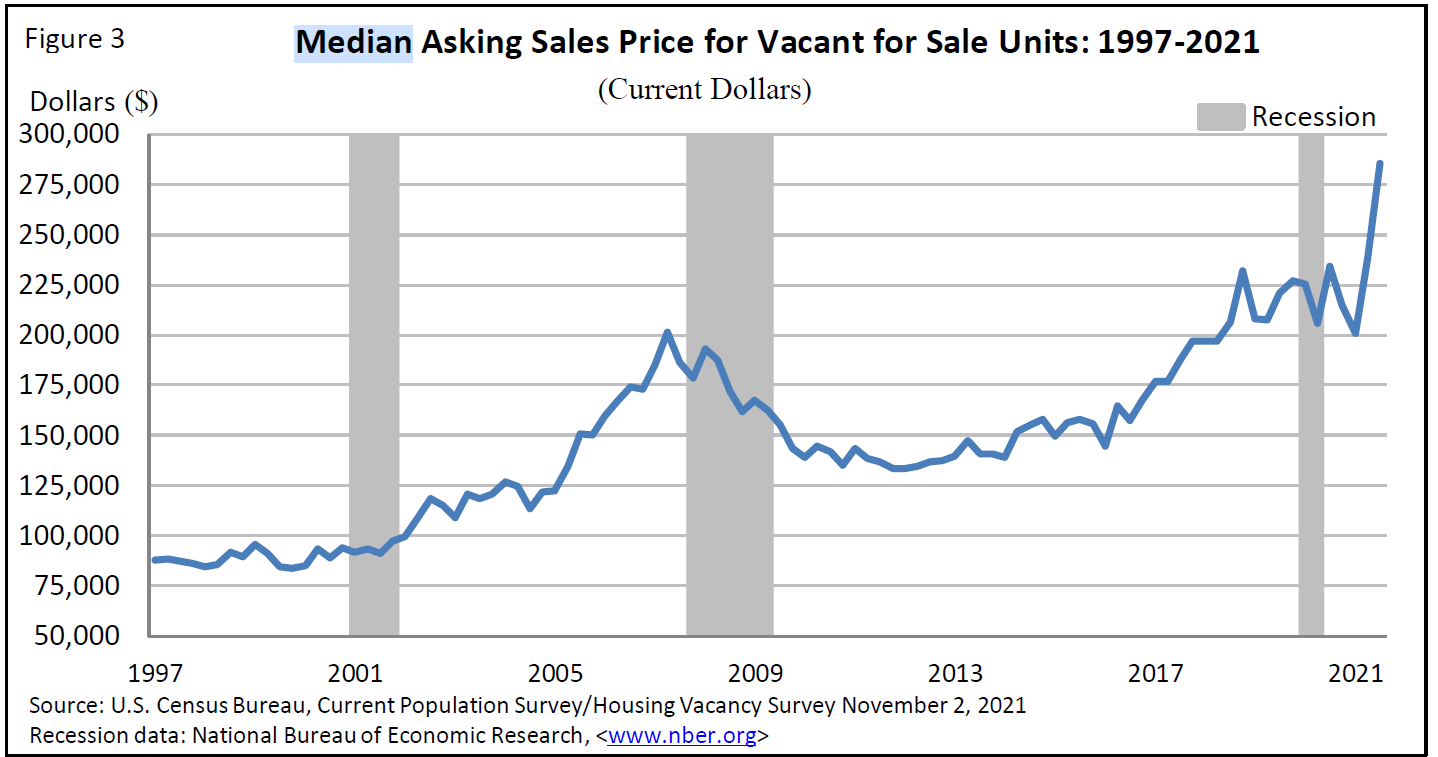

The median asking sales prices for vacant homes for sale was $285,500[5] in 2021 Q3 as compared to approximately $175,000 in 2017, representing a 38.7% increase in cost.

What can be done?

Lenders seeking to improve their CRA and fair lending performance can help close the housing gap. Success starts with understanding the specific barriers to housing affecting your communities. Local community housing leaders and non-profit housing organizations can offer valuable insights, as can publicly available economic, demographic, and community information.

Financial institutions cannot affect the availability of affordable housing stock or the affordability pricing gap in real estate; however, they can offer affordable lending loan products and loan programs that assist LMI first time homebuyers with down payment and closing cost funds.

These programs are quite extensive. Provided below is a list (not comprehensive by any means) that provides programs that being offered today that you can use to help your LMI and first-time-homebuyers achieve homeownership.

- Educate and encourage your financial institution to offer Affordable Lending Homeownership Programs for first-time and low-to-moderate income homebuyers.

- FHA, VA, USDA’s Rural Development, Fannie Mae, and Freddie Mac – these governmental agencies offer mortgage loan products for first-time homebuyers. They also offer homebuyer education.

- Housing Choice Voucher Program – public housing residents and others with low income who are first-time homebuyers and receive housing vouchers can use the income towards the income qualification to purchase a home versus renting (these loans can be sold by lenders in the secondary market to Fannie Mae, Freddie Mac, and FHA).

- State and local housing authority[6] programs that offer special products for low-to-moderate income first-time homebuyers.

- These programs typically offer low interest rate mortgage loans for first-time LMI homebuyers, and usually offer down payment/closing cost assistance or grants.

- Reach out to local Community Development Corporations (CDCs) and non-profits invested in first-time homeownership needs and available grant programs that may be used to assist your homebuyers. These organizations are a great source of information about the housing needs in their individual community, which could lead to opportunities to build relationships and partnerships.

- Research Federal Home Loan Bank[7] programs for homeownership, below is a list of programs currently available.

- First-time Homebuyer Product – provides up to $5,000 in down-payment, closing-cost, and principal reduction assistance for eligible first-time homebuyers.

- Community Partners Product – provides up to $7,500 in down-payment, closing-cost, and principal reduction assistance for homebuyers who are currently employed or retired law enforcement officers, educators, firefighters, health care workers, and other first responders.

- Foreclosure Recovery Product – provides up to $15,000 in down-payment, closing-cost, and principal reduction assistance for eligible homebuyers purchasing properties from the Real Estate Owned inventory of any FHLBank member financial institution.

- Community Rebuild and Restore Product – provides up to $10,000 for the rehabilitation of an existing owner-occupied home located in “Major Disaster Declaration” or COVID-related disaster areas as designated by the Federal Emergency Management Agency (FEMA). Funds can be used to correct deficiencies, resulting from the identified disaster, that impact the habitability of the property not associated with repairs covered under an insurance claim.

- Veterans Purchase Product – provides up to $7,500 in down-payment, closing-cost, and principal reduction assistance for homebuyers who are veterans or active-duty members of the U.S. military, their spouses, or their surviving spouses.

- Returning Veterans Purchase Program – provides up to $10,000 in down-payment, closing-cost, and principal reduction assistance for homebuyers who are currently serving or have served in an overseas military intervention for any branch of the U.S. military, their spouses, or their surviving spouses.

All of the aforementioned options are available for bankers and mortgage bankers to assist your institutions in meeting the needs of underserved populations in your lending market.

[1] This Year, Half As many Metro Areas are Affordable to Low-Income Homebuyers as Last Year

[2] Low-to-moderate income = < 80% of MSA median family income

[3] Great American Exodus: What the move to the suburbs means for the real estate market

[4] Housing Market Tightness During COCID-19: Increased Demand or Reduced Supply?

[5] https://www.census.gov/housing/hvs/files/currenthvspress.pdf

[6] Conduct an internet search using the State name where financial assistance is needed, and “housing finance corporation/development/authority/agency” to start your search.

[7] Available for member banks.