Change has always been a constant in mortgage servicing, and the COVID-19 pandemic has taken change to a new level. Mortgage servicers were already accustomed to continually shifting customer bases, product portfolios, regulatory requirements, and technology innovations. The pandemic has triggered a whole other wave of impacts to their operations, including changes in approach, execution, and expectations of both customers and service providers. A quantum leap from brick-and-mortar operations and processing to remote execution was the hallmark of 2020, and the trend has continued well into 2021.

In turn, mortgage servicers are redefining their internal objectives and how they will continue to address customer needs. Even with all the changes occurring, the overall expectation of a reliable and sustainable process abides. In other words, even with more and more remote processing taking place in the industry today, there is still a strong need for solid operating processes to ensure an organization completes all tasks needed to deliver proper outputs on time and within budget while providing excellent customer service. Add to that the ever present need to maintain cost drivers, improve cycle times, provide adequate business controls, and minimize risks while not compromising on security needs like data integrity and borrower privacy. Then add regulatory compliance on top of it all.

Responding to New Digital Demands

An area of constant focus is existing and new customer interaction. One outcome from all the digitization efforts of the last 18 months is that consumers are becoming more self-educated on mortgage servicing regulations, products, state laws, and delivery expectations. Consumers are researching their financial options more intently than ever before.

As more digital tools are placed in consumers’ hands, mortgage servicing companies and their employees need to be ready to respond with a complete understanding of the process. Only in that way can they manage the basic technology demands from online processing, respond to information requests, tailor product offerings, handle initial application processing, and vet customer eligibility. With the continued emphasis on transparency, it is more important than ever to be ready to engage with customers on proper timelines for documentation receipt, offer reviews, counteroffers, acceptances, and complaints—all while maintaining adherence to regulatory and investor requirements.

Satisfying Regulators’ Post-Pandemic Expectations

The Consumer Financial Protection Bureau (CFPB) has been sending out subtle and not so subtle rule updates making it clear that mortgage servicers need to be prepared to address homeowner needs as COVID-19 relief provisions including loan forbearance and eviction moratoriums expire later this year. The expectation is that, prior to the expiration dates, mortgage servicers have, or shortly will have, plans in place to make additional good faith efforts to establish contact with borrowers and help them retain their homes.

Every borrower outreach (and there should be a lot of outreach), each subsequent borrower interaction, and all follow-up transactions must be documented in the system of record and available for review by regulators. It is also becoming critical for an organization to have the proper monitoring and compliance safeguards in place to address process breakdowns and increases in defects. Many complaints reviewed by the CFPB relate to timelines not met, lack of response to follow-up questions, and unclear or confusing communication channels.

Roadmapping Post-Pandemic Transformation

In this new environment, business process management (BPM) and business process modeling take on even greater significance as they assist mortgage servicers in monitoring, tracking current processes, and using change control management to update processes for future needs. Business process management is a holistic discipline for documenting, analyzing, improving, and maintaining business processes. Business process modeling involves the methods and tools that support business process management.

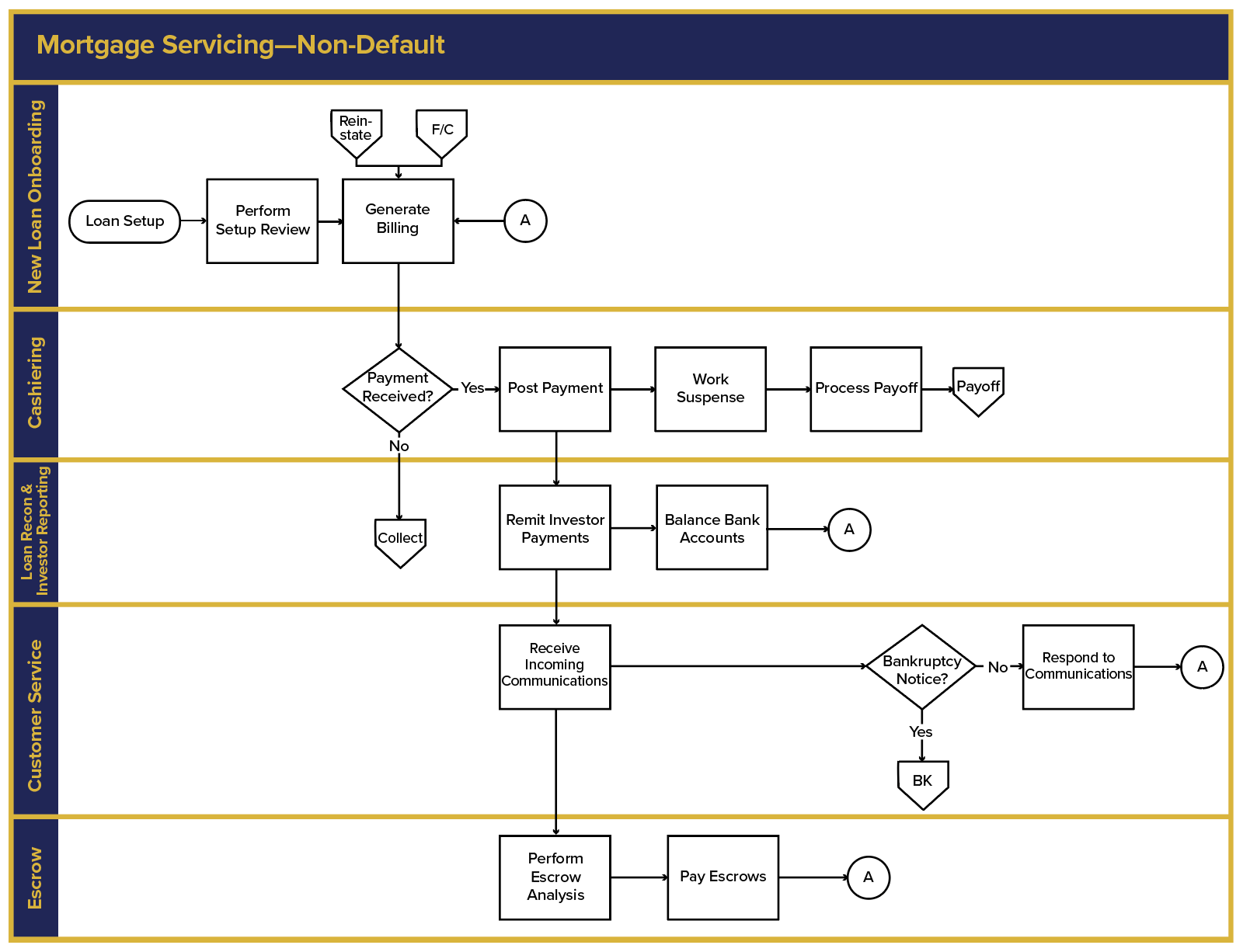

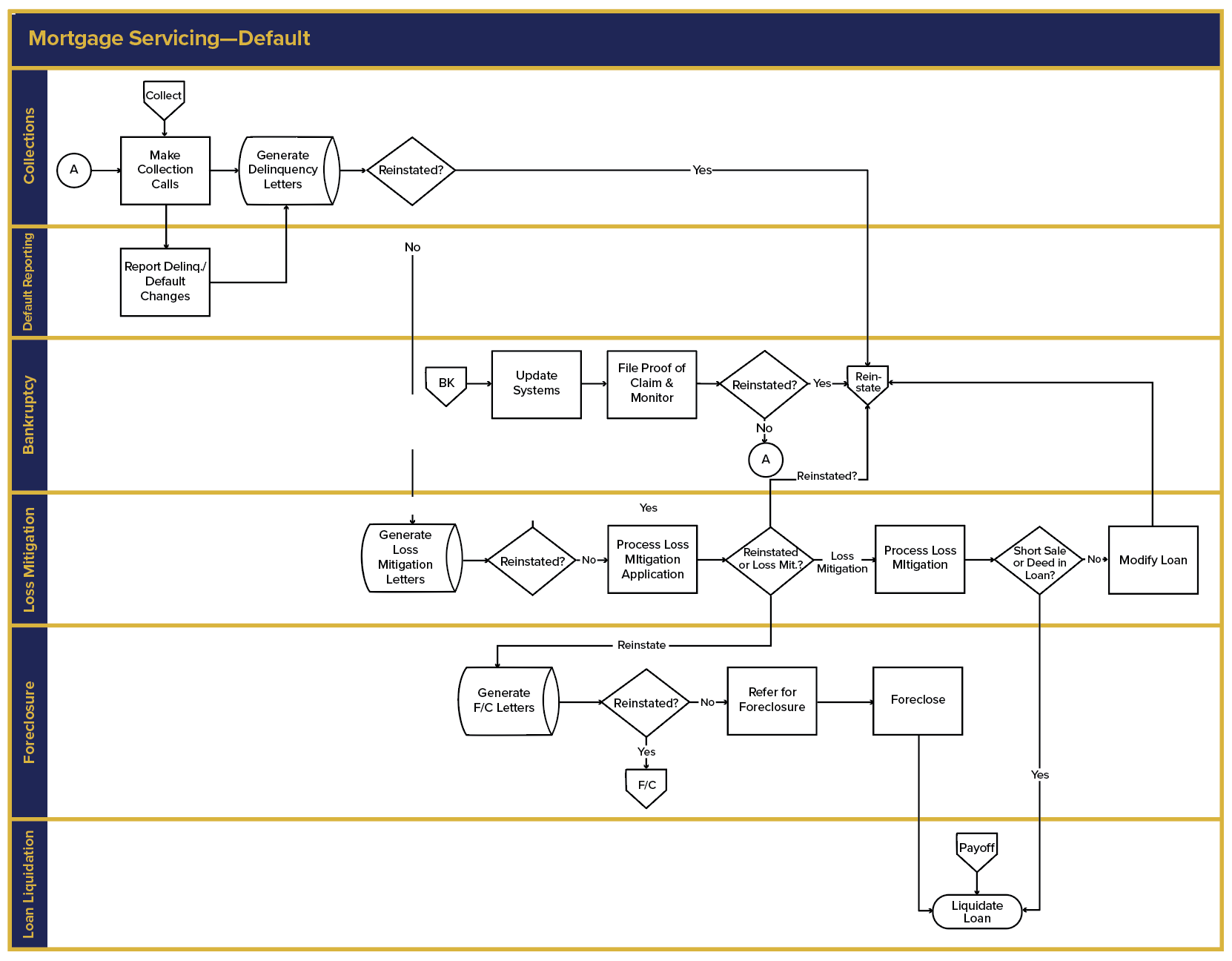

BPM is a graphical representation of a company’s business processes. The completed maps of current state processes become the foundation for assessing operational tasks, inherent risks, strength of process controls, gaps, handoffs, and the blueprint for change management activities to develop a sustainable future state. All this provides the basis for an organization’s continual business transformation journey.

As we noted in Treliant’s previous article, “Business Process Modeling: A Key to a Successful 2021,” process transformation means not just improving your processes but combining them, breaking them up, or otherwise transforming them into new ways of accomplishing your goals. Having a clear vision of the future state helps a mortgage servicer know where the organization needs to be down the road. But that vision can only be achieved if it is grounded in a sustainable process that servicers can rely on to know where they are today in terms of process, risks, customer needs, digital paper trails, controls, gaps, compliance, and regulator and investor requirements.

Effecting Change Management

With all the actual and potential changes in the next six to 12 months, it is more important than ever for servicers to be planning their response to the needs of their current and future customer base, regulators, and investors. BPM is one of those potential solutions that will get servicers ready to meet ongoing challenges like future state process development, active monitoring updates, defect identification, complaint management, gap assessment and acknowledgement, and active risk identification and remediation.

BPM will also assist in promoting change management in a controlled and verifiable manner. Now more than ever, it is important for all company employees to understand their process and all upstream and downstream process impacts. Figure A, on the following page, shows the interdependency and reliance among groups, as a high-level representation of the mortgage servicing process.

As changes occur, BPM will enable the staff to more readily understand and incorporate those changes into their process and monitoring activities. This will ensure that transitions from one working group to another will be executed timely without any lost time or failed process actions. It will allow an organization to manage needed change instead of reacting to defects or process breakdowns from inadequate planning or process management.

Finally, since the main participants in the BPM program are an organization’s internal management and staff, the ongoing out-of-pocket investment in tools and continuing education for employees is a manageable cost, especially compared to the benefits of the overall program.

The Takeaway

A well-established BPM program will allow an organization to continually assess its current processes and their supporting monitoring and management tools. This will allow an organization to adapt to new situations and provide transparency across organizational levels.

Figure A: Mortgage Servicing—Non-Default and Default