It was back in 2017 that then-Financial Stability Board (FSB) Chair Mark Carney made a bold statement: “The global financial system has been reregulated—leaving a safer, simpler, and fairer financial system that can support open markets and inclusive growth.” For this achievement, Carney credited the G20’s rapid creation of the FSB in the wake of the global financial crisis, “to fix the fault lines of the financial system, working with national authorities and international standard-setting bodies.”

Fast-forward to today’s bank failures, and one can safely state that the problems remain far from fixed, with fault lines still running through the financial system. Otherwise, how does one explain the collapse of Silicon Valley Bank (SVB), a bank whose assets almost doubled from $116 billion at the end of 2021 to $216 billion at the end of 2022?

Back in 2008, Washington Mutual witnessed a record cash outflow of 15 billion USD over a period of 12 days (between September 11-28, 2008). However, SVB recorded 42 billion USD cash outflow in just 24 hours on March 9, 2023!

The “Twitter-speed” run on SVB has left many questions unanswered, with the collective ownership of potential systemic failures squarely resting on both sides of the aisle—the banks’ as well as the regulators’. “Default risk” by SVB was not the culprit, but rather the changing interest rate environment. In other words, SVB’s failure can largely be attributed to interest rate risk and a colossal failure of asset and liability management (ALM).

Regulators’ very purpose in introducing standards addressing interest rate risk in the banking book (IRRBB) was to ensure that banks have appropriate capital to cover potential losses from exposures to changes in interest rates. Equally important, they aimed to prevent regulatory arbitrage between trading and banking book exposures. At the risk of oversimplifying, the Basel Committee on Banking Supervision’s (BCBS’s) IRRBB standards address two key components:

- Standardized minimum capital requirement built on two metrics, both of which are measured under six interest rate scenarios:o Economic value of equity (EVE) = Present value of assets cash flows — Present value of liabilities cash flows

o Net interest income (NII) - Twelve guiding principles, of which the first nine address scope, governance, measurement, reporting, and disclosure frameworks while the last three provide detailed guidance on conducting supervisory reviews.

As witnessed by the changing interest rate landscape over the last few years, banks are required to strike a delicate balance between NII sensitivity to rate changes against EVE sensitivity to rate changes and correlate those sensitivities to shareholders’ expectations. Doing so requires addressing and overcoming fundamental practical challenges in managing the IRRBB including:

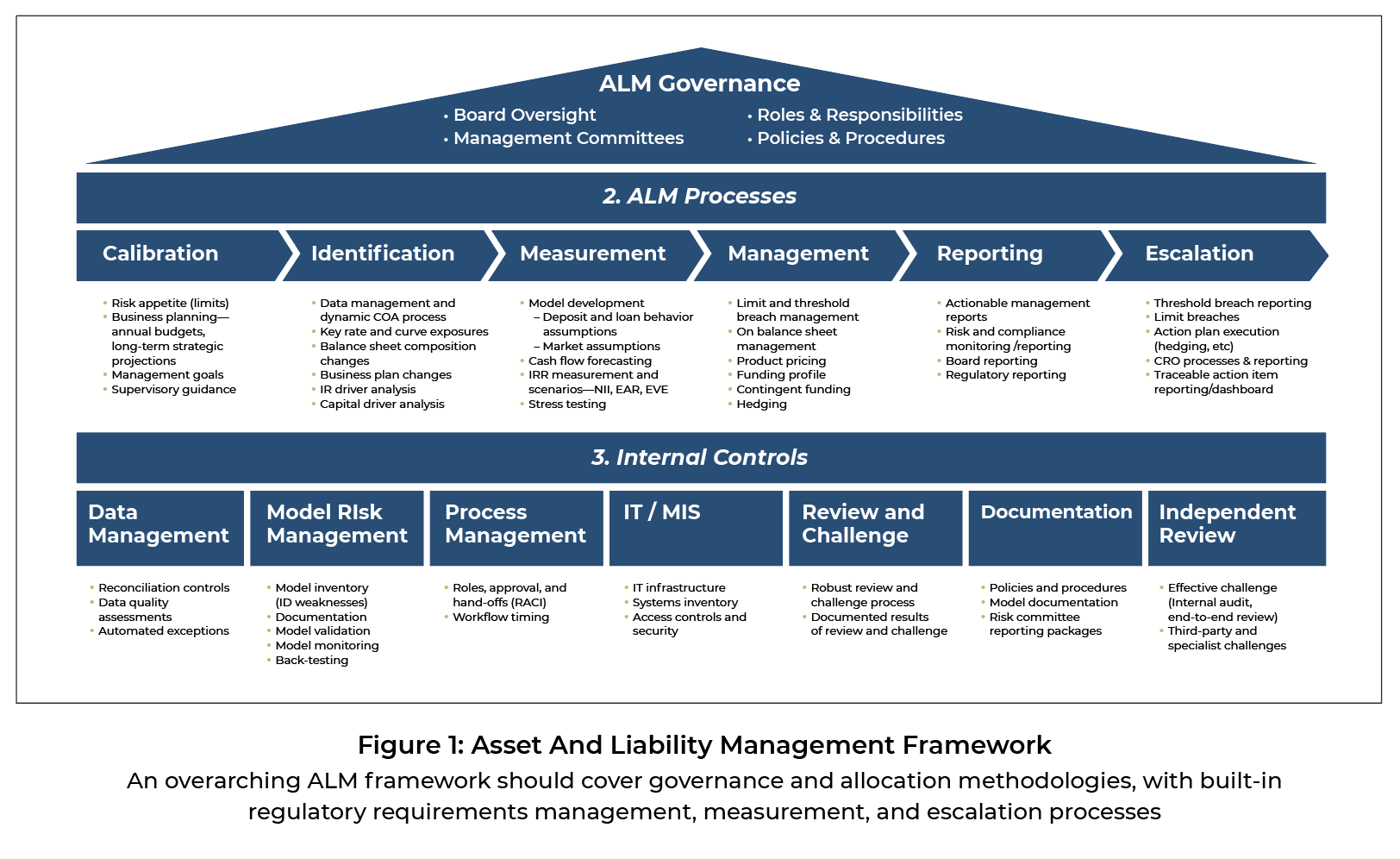

- Governance (see Figure 1): An overarching ALM framework should cover governance and allocation methodologies, with built-in regulatory requirements management, measurement, and escalation processes. Banks should put IRRBB at the core of this framework for managing not just the interest rate risk but also other risks such as stress testing and financial planning, to provide a holistic view of banking and trading book activities. The right governance framework should find the least common denominator among model risk management, the limit framework, and identification of the right roles for the right people. In essence, a bank’s asset-liability committee (ALCO) should create a tightknit interaction among the ALCO, ALM, and IRRBB models to ensure proper validation of the behavioral models.

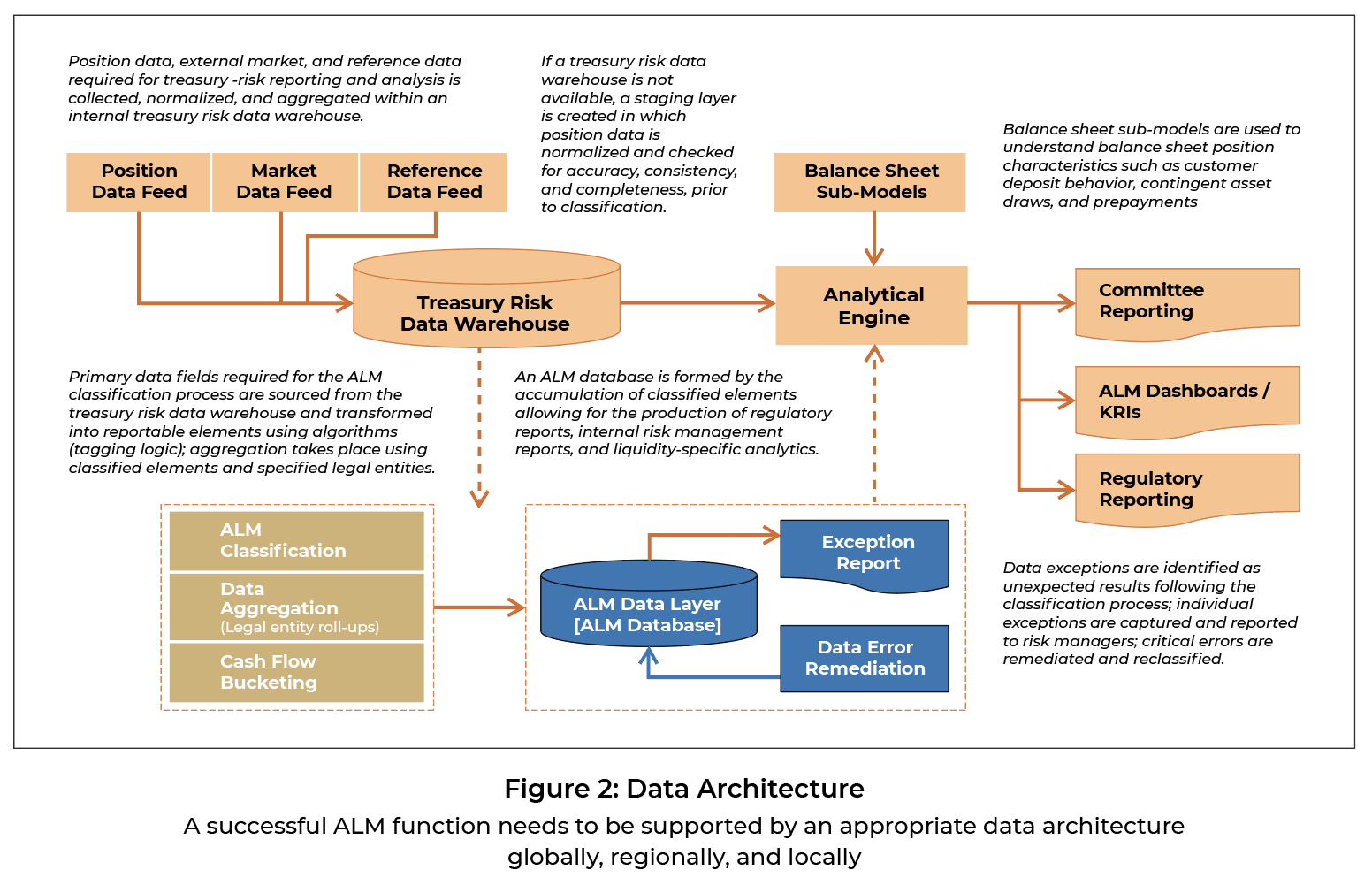

- Data (see Figure 2): This is the foundational building block toward effectively managing credit and liquidity risk. The burning question for banks ought to focus on whether they have the aggregated and granular data required to measure interest rate risk. As witnessed by the recent bank failures, it is highly likely that banks lack the historical data to model the required scenarios (as outlined in BCBS principle 5) mainly because the banks have been operating in an abnormally low interest rate environment since the 2008 global financial crisis. One way to mitigate this challenge is to look back at the preceding years, but they may not necessarily reflect the current clients, channels, and behavior. So, banks’ corporate leaders need to collaborate with their business line executives for the systemic collection of qualitative information to test out various assumptions. This then becomes a proxy to demonstrate that the bank’s management is well equipped to deal with an unforeseen event.

- Modeling: At its core, a bank should determine if it has appropriate models to measure interest rate risk. If such models exist, does the bank have sufficient data to calibrate them? To determine how an instrument’s maturity can diverge from the instrument’s contractual terms due to behavioral options, banks need to ask themselves questions including:

o What data do we need?

o How to determine the volatile part?

o How do we define and aggregate the core components of non-maturity deposit?

More often than not, banks tend to build a model that is not fit for purpose largely because of inadequate data or improperly catalogued data. The EVE metric in particular is likely to be impacted by certain assumptions in quantifying the risk. These might include the treatment of balances and interest flows arising from non-maturity deposits and expectations for the embedded interest rate options by the bank and its customers against specific interest rate shock and stress scenarios. Banks need to move away from static modeling measures based on recent financial results and a constant balance sheet. It is time for banks to embrace a dynamic modeling approach that allows for integrating capital planning, counterparty credit risk, budgeting, and IRRBB.

How Treliant Can Help?

Treliant can provide comprehensive coverage of end-to-end ALM activities including:

-

- Review of current performance management and asset and liquidity management activities including capital and liquidity management, RWA calculations, various risk calculations (IRR, structural FX risk, etc.), collateral management, funding management, and balance sheet management

- Integration of ICAAP, ILAAP, RAF, and budget at the corporate level to deliver a consistent financial planning framework

- Support to business lines for a sound optimization and allocation of scarce resources, and the alignment of pre-trade and post-trade norms and methodologies for financial steering