Over the past several months, numerous news articles and academic and industry studies have alleged discrimination against minority applicants in home valuations. Some estimates place the cumulative loss of value to black communities from flawed valuations in excess of $150 billion.

Now, banking and housing regulators in Washington have outlined a concerted campaign against appraisal and valuation bias. Their joint action plan, released in March, provides new impetus for lenders to self-assess and correct any flaws in their processes for home valuations, as described below.

The price of inaction could be high. Already last year, the Department of Housing and Urban Development (HUD) and a major bank reached a multimillion-dollar conciliation agreement related to discrimination in multiple valuations and reconsideration of value (ROV) processes. Additional risks include reputational damage and the loss of borrowers’ business.

Is There a Valuation Gap?

The Brookings Institute used census and real estate market data to conduct a study of owner-occupied home values in U.S. Metropolitan Statistical Areas (MSAs).1

The authors found that homes in Majority Black Census Tracts (MBCTs) are valued at roughly half the price of homes in neighborhoods that have no black residents. In addition, location in an MBCT predicts a negative valuation gap for 117 of the 119 MSAs containing MBCTs, although there are wide variations in the size of the valuation gap.

Differences in home and neighborhood quality and amenities do not account for all of the differences in valuations, since homes in MBCTs are worth 23 percent less than homes in neighborhoods with few black residents even after controlling for differences in crime rates, commute times, school quality, and entertainment options. Across all MBCTs, the average undervaluation for owner-occupied homes is $48,000, with undervaluation of homes in MBCTs more pronounced in MSAs that are more segregated.

Does Appraisal Bias Contribute to the Valuation Gap?

Using data from their loan purchase operations, Fannie Mae and Freddie Mac each conducted an analysis of appraisal outcomes to determine if there was evidence of bias.

… In Home Purchase Transactions

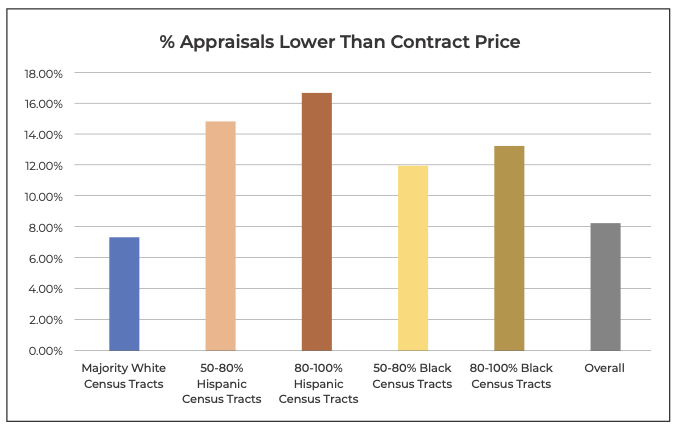

The Freddie study2 compared appraised values to contract prices for home purchase transactions and found that appraised values are more likely to be less than the contract price in MBCTs and Majority Hispanic Census Tracts (MHCTs) than in Majority White Census Tracts (MWCTs). As the black or Hispanic population of a neighborhood increased, so did the gap between the appraised value and the contract price. The valuation gap was generally present regardless of whether the valuation was based on a full appraisal, exterior-only appraisal, or a desktop appraisal. In addition, the findings were persistent across occupancy types, property conditions, urbanization levels, and neighborhood housing trends. The national pattern was repeated in analyses of the top 30 MSAs.

The Freddie study also found that African-American and Hispanic applicants are more likely to receive appraised values that are less than the contract price regardless of neighborhood demographics, although this result may be skewed somewhat because the mortgage applicants’ demographics, rather than the property owners’ demographics, are reported under the Home Mortgage Disclosure Act. Nationally, 9.5 percent of Hispanic applicants and 8.6 percent of African-American applicants received appraised values less than the contract price, compared to only 6.5 percent of white applicants.

Source: Treliant analysis of Freddie Mac data

In the Freddie study, there were 934 appraisers with sufficient valuations in both MBCTs and MWCTs and 1,560 appraisers with enough valuations in MHCTs and MWCTs to conduct appraiser-level analyses. In the appraiser-level comparison of MBCTs and MWCTs, 54 percent of the appraisers had statistically significant appraisal gaps. In the appraiser-level comparison of MHCTs and MWCTs, 47 percent of appraisers had statistically significant appraisal gaps.

… In Refinance Transactions

The Fannie study3 compared appraised values and valuations from two automated valuation models (AVMs) for refinance transactions. For the purposes of their analysis, Fannie Mae considered appraised values that exceeded the AVM valuation by 10 percent or more to be overvalued, and appraised values that were at least 10 percent lower than the AVM valuation to be undervalued. Based on 1.8 million refinance appraisals in 2019 and 2020, Fannie found that, in both MBCTs and MWCTs, black borrowers on average received appraised values that were slightly lower than AVM valuations while white borrowers received appraised values that were slightly higher than AVM valuations.

In the Fannie data, white-owned homes were overvalued in all neighborhood types, but overvaluations were most likely to occur with white-owned homes in MBCTS. Undervaluation rates for black- and white-owned homes were similar in both MBCTS and MWCTs. In short, undervaluation did not have a notable racial pattern, but overvaluation did. In addition, six states—Alabama, Georgia, Louisiana, Mississippi, North Carolina, and South Carolina—accounted for nearly 50 percent of overvalued white homes in MBCTS.

Analyzing Bias in Appraisers’ Comments

The Federal Housing Finance Agency (FHFA) conducted a keyword analysis of the commentary of millions of appraisals.4 FHFA found numerous inappropriate references to race or other protected classes in the appraisals. This was despite appraiser certifications in the Uniform Residential Appraisal Report (URAR) that “I did not base, either partially or completely, my analysis and/or opinion of market value in this appraisal report on the race, color, religion, sex, age, marital status, handicap, familial status, or national origin of either the prospective owners or occupants of the subject property or of the present owners or occupants of the properties in the vicinity of the subject property or on any other basis prohibited by law.”

Examples of racial, ethnic, cultural, and religious references identified included neighborhood racial and ethnic composition; immigrant status of residents; languages spoken in an area; amenities geared to a specific race, religion, or culture; references to white flight and sundown towns; discussion of the demographics of local government members; and diversity of school systems.

Federal Government Launches Response

To combat bias in property appraisals and valuations, President Biden directed HUD to convene a multi-agency task force to address inequity in home valuations by using enforcement activity, regulatory action, and the development of standards. The resulting Property Appraisal and Valuation Equity Task Force (PAVE) is co-led by HUD Secretary Marcia Fudge and White House Domestic Policy Advisor Susan Rice. It is composed of 13 federal agencies and offices, including HUD, the White House Domestic Policy Council, Federal Reserve Board (FRB), Consumer Financial Protection Bureau (CFPB), Federal Deposit Insurance Corporation (FDIC), FHFA, National Credit Union Administration (NCUA), Comptroller of the Currency (OCC), Department of Agriculture (USDA), Department of Justice (DOJ), Department of Labor, Department of Veterans Affairs (VA), and Appraisal Subcommittee of the Federal Financial Institutions Examination Council (ASC).

In March 2022, PAVE released its “Action Plan to Advance Property Appraisal and Valuation Equity: Closing the Racial Wealth Gap by Addressing Mis-valuations for Families and Communities of Color.”5 In the plan, federal banking and housing regulators have committed to act to address appraisal and valuation bias through both rulemaking and examination processes. Some of the planned actions include:

- The CFPB, DOJ, VA, and HUD will issue guidance to clarify the applicability of Federal Housing Administration (FHA) and Equal Credit Opportunity Act (ECOA) rules to the appraisal industry.

- The NCUA, FRB, FDIC, OCC, HUD, USDA, and VA will ensure that appraisers’ or regulated institutions’ use of appraisals is directly included in supervisory FHA and ECOA compliance requirements, and is considered in every review of relevant existing and future policies and guidance.

- HUD will require FHA lenders to track usage and outcomes of requests for ROVs and report this data to HUD.

- The FDIC, FRB, OCC, and NCUA will issue guidance to encourage effective and nondiscriminatory use of ROVs. These agencies will also consider whether formal rulemaking is needed.

- PAVE agencies participating in rulemaking related to AVMs will include a nondiscrimination quality control standard in the proposed rule.

- PAVE agencies will strengthen coordination among supervisory and enforcement agencies to identify discrimination in appraisal and valuation processes by aligning investigative protocols, developing data analysis approaches, and identifying illustrative case studies. If needed, the federal banking supervisory agencies will modify or develop new interagency memoranda of understanding (MOUs) to facilitate information sharing.

- The federal banking agencies will enhance examination procedures to include identification of appraisal bias in examinations of mortgage lenders, including annual data analyses and reviews of examinations to improve effectiveness in identifying patterns of valuation bias.

- HUD will update its Fair Housing Initiatives Program to include grants for appraisal bias testing.

- On March 29, 2022, House Financial Services Committee Chair Maxine Waters introduced a bill to establish a new Federal Appraisal Regulatory Agency.6 If passed, the bill would also establish a federal process for reporting appraisal discrimination and appraiser misconduct complaints and enhance statutory penalties for appraisal discrimination. This legislation would address some of the concerns identified by PAVE.

How Should Lenders Prepare?

Since a subset of the agencies on the PAVE Task Force issued Interagency Appraisal and Evaluation Guidelines 12 years ago (2010 Guidelines),7 many banks have established effective programs to ensure that independent appraisals and valuations are consistent with supervisory guidance and safe and sound banking practices. Features of such programs include independence of the persons ordering, performing, and reviewing appraisals from loan production staff; controls to prevent undue influence of valuations; selection and monitoring of qualified appraisers and appraisal reviewers; minimum appraisal standards; identification of transactions requiring appraisals or evaluations; and appraisal and evaluation review processes.

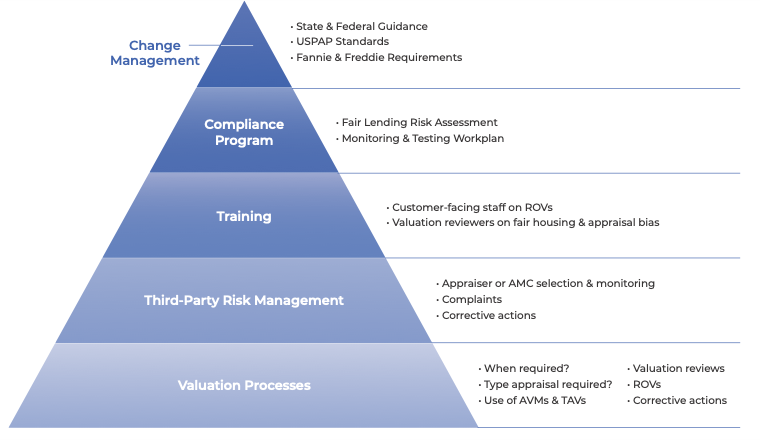

Now, under the task force’s new action plan, scrutiny of appraisal and valuation processes will intensify. Lenders should manage their risks by ensuring that these processes are robust, taking the following steps:

Evaluate Valuation Practices

First, evaluate your appraisal usage practices.

- Are you consistent in your determinations of which loans require an appraisal or valuation and the types of valuations required for a given loan?

- Has the institution implemented the flexibility for use of evaluations instead of appraisals permitted by the Interagency Advisory on Use of Evaluations in Real Estate-Related Financial Transactions (2016 Guidelines)?8

- What about the ability to use exterior-only and desktop appraisals, appraisal waivers, or lender variances for certain loans under the Interagency Statement on Appraisals and Evaluations for Real Estate Related Financial Transactions Affected by the Coronavirus (COVID Guidelines),9 the Appraisal Standards Board’s 2020-21 USPAP Q&A,10 or the Fannie11 and Freddie12 COVID accommodations?

- Recalling that the Dodd-Frank Act13 prohibits use of broker price opinions (BPOs) as the primary source of valuation for residential mortgage loan origination: Are BPOs being used for other valuation needs?

Second, if your institution uses AVMs or Tax Assessment Valuations (TAVs), ensure your usage conforms with regulatory expectations. The 2010 Guidelines permit use of AVMs and TAVs that are consistent with safe and sound banking practices, but caution lenders to avoid unsupported assumptions, such as assuming the property is in “average” condition. If your institution uses AVMs, ask yourself:

- Do you have clear policies and procedures governing their use, specifying the supplemental information required, and establishing criteria for accepting the AVM’s valuation for a transaction?

- Has the institution independently validated the AVM in accordance with its model risk management standards, including validation for specific geographies and property types?

- For TAVs, has the institution documented the tax jurisdiction’s calculations of TAV, the frequency of property revaluations, and the correlation (and correlation stability) between TAVs and market values?

In light of the current scrutiny of valuations, it is a best practice to determine whether AVM or TAV performance is consistent across neighborhoods of differing demographic patterns.

Third-Party Risk Management

Third, consider how appraisers are selected and monitored.

- Does the institution have sufficient controls to ensure that the appraisers are qualified, licensed, independent, and have sufficient experience with the property type being appraised?

- Does the contract require sharing complaints related to the institution’s applicants?

- Does the institution monitor direct and indirect complaints about appraisals or appraisers for indications of inappropriate or unprofessional behavior?

- Does the institution endeavor to include diverse appraisers in its approved appraiser lists?

- What fair housing and fair lending training requirements must be met by appraisers?

- Does the appraiser or appraisal management company have adequate policies and procedures to appropriately address fair housing risks?

- If appraisal reviews or monitoring detect bias, does the institution have processes for corrective action?

Fourth, make sure complaints alleging appraisal and valuation bias are appropriately recorded and resolved. Any weaknesses identified through root cause analysis of complaints should be remediated.

Training

Fifth, have you adequately trained staff? All customer-facing staff should receive annual fair lending and fair housing training. In addition, they should be aware of ROV processes as well as complaint procedures to ensure applicant requests for ROVs are promptly and appropriately considered. Appraisal review staff should also receive annual training on fair housing and fair lending that includes training on appraisal bias. Appraisal reviewers should evaluate the full appraisal, including free-form comments on the property and the neighborhood for evidence of discrimination. Appraisals containing comments such as those found in the FHFA analysis should render an appraisal unacceptable. In addition, lenders should consider corrective action for appraisers making such comments.

Compliance Program

Sixth, if your fair lending risk assessment does not consider risks associated with appraisal bias, enhance the risk assessment to incorporate this risk. Similarly, if your fair lending monitoring and testing work plan does not include reviewing appraisals from a fair lending and fair housing perspective, consider adding an appraisal and valuation review to assess the quality and appropriateness of the appraisals received by your institution. This is especially true if the institution has a greater proportion of loan applications declined for reasons related to collateral or loan-to-value (LTV) ratios in minority neighborhoods.

Change Management

Finally, monitor developments in federal and state regulatory guidance, the Uniform Standards of Professional Appraisal Practice (USPAP), and Fannie and Freddie requirements. Ensure that any required changes and emerging best practices are promptly incorporated into your policies, procedures, and practices. From a credit risk and capital markets perspective, the PAVE Task Force’s concept of using range-of-value estimates instead of point value estimates would have significant operational impacts. The pending rulemaking on AVMs14 may be particularly relevant, as will any changes in appraisal requirements or standards promulgated by regulators, Fannie, or Freddie. PAVE members have promised additional scrutiny, and your institution does not want to be caught unprepared.

Components of a Robust Appraisal and Valuation Risk Management System

____________________________________________________

2 https://www.freddiemac.com/fmac-resources/research/pdf/202109-Note-Appraisal-Gap.pdf

3 https://www.fanniemae.com/research-and-insights/publications/appraising-the-appraisal

4 https://www.fhfa.gov/Media/Blog/Pages/Reducing-Valuation-Bias-by-Addressing-Appraiser-and-Property-Valuation-Commentary.aspx

5 https://pave.hud.gov/sites/pave.hud.gov/files/documents/PAVEActionPlan.pdf

6 https://financialservices.house.gov/uploadedfiles/bills-117pih-endingappraisaldiscriminationactof2022.pdf

7 https://www.gpo.gov/fdsys/pkg/FR-2010-12-10/pdf/2010-30913.pdf

8 https://www.occ.gov/news-issuances/bulletins/2016/bulletin-2016-8a.pdf

9 https://www.federalreserve.gov/newsevents/pressreleases/files/bcreg20200414a2.pdf

10 https://appraisalfoundation.sharefile.com/share/view/s607dbda9e9b41cb9

11 https://singlefamily.fanniemae.com/media/22321/display

12 https://guide.freddiemac.com/app/guide/bulletin/2020-5

13 https://www.govinfo.gov/content/pkg/PLAW-111publ203/pdf/PLAW-111publ203.pdf

14 https://files.consumerfinance.gov/f/documents/cfpb_avm_outline-of-proposals_2022-02.pdf