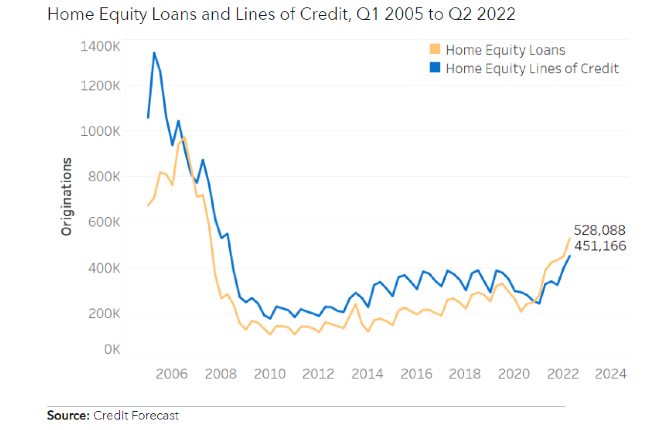

In the current environment of increasing mortgage rates and decreasing home refinancing, lenders are turning their focus to other lines of business while borrowers seek out alternative options for financing their goals. Specifically, with mortgage rates at 6% and higher, home equity lines of credit (HELOCs) are quickly regaining popularity. Statistics show that HELOC originations were up 30% year-over-year in 2022, to a level not seen since 2007. The increase in the second quarter alone was 37% over 2Q21.1

With this rapid increase after a 15-plus-year period of fairly steady originations, now is the right time to visit or revisit testing of HELOC origination and servicing portfolios. It is vital for financial institutions to establish sufficient safeguards with up-to-date testing that focuses on HELOC-related regulations and ensures compliance.

Mortgages vs. HELOCs

Some lenders may question why there is a need to target HELOC testing if a lender is already testing its mortgage portfolio, and the answer is simple: HELOCs are not mortgages.

Yes, mortgages and HELOCs are similar in the sense that both allow borrowers to use property as a means to secure financing and repay over a fixed term.2 Moreover, both fall under the purview of the “Big Three” regulators: the Consumer Financial Protection Bureau (CFPB), Office of the Comptroller of the Currency (OCC), and Federal Reserve. And, they must both comply with the Equal Credit Opportunity Act (ECOA), Flood Disaster Protection Act (FDPA), Real Estate Settlement Procedures Act (RESPA), and Truth in Lending Act (TILA). In the eyes of the regulators, however, that is where their similarities end.

Different Classification, Different Standards

Mortgages are classified as closed-end credits and face a different set of standards than HELOCs, which fall under the category of open-end credit.3 Due to the differences in the type of credit, HELOCs and mortgages are treated differently. As such, additional testing steps are required for HELOCs to ensure that the controls in place work as intended to protect consumers from predatory practices.

HELOCs face a completely different set of disclosure requirements and servicing standards. Under TILA, the origination of HELOCs requires a distinct set of disclosures. For instance, given that lenders may terminate a contract or suspend future advances, borrowers must be provided with a list of conditions or circumstances under which such action would be taken. Borrowers must also be notified of how the annual percentage rate (APR) is determined, told how and when the rate or payments may change, and given a sample payment plan.

Similar to TILA, the ECOA has its own set of disclosure requirements. For example, when an application is denied, the lender is required to inform the borrower of the reason for denial, the credit score, and details if the reason was based on that score. As TILA requires borrowers be notified of their right to a fee refund, ECOA confirms whether those fees were refunded when an application is canceled, withdrawn, or denied. ECOA also places time frames on the disclosure of actions taken on the application, whether it be a denial, a counteroffer, or notice to the borrower of an incomplete application.

Unlike mortgages, HELOCs are not subject to TILA-RESPA integrated disclosures (TRID), and therefore do not require loan estimates or closing disclosures. However, specific RESPA standards must be met, such as the disclosure of term conditions, security interest, and risk to the home, as well as the payment terms, including the length of the draw period and repayment period. Similarly, when establishing an escrow account, analyses must be performed to determine the deposit amount required in the period payments.

The servicing of HELOCs differs greatly from the servicing of traditional mortgages. Given the inner workings of open-end credit and the draw system, lenders and servicers may need a separate servicing system to address draw requests, interest accruals, and draw periods. As such, specific rules must be followed.

Similar to the disclosure requirements involved in the origination of a HELOC, the regulations identify specific criteria required for servicing HELOCs. For example, TILA requires borrowers be notified if a term identified in the account opening disclosure changed, the required minimum payment increased, extensions are prohibited, or limits reduced. Where a borrower’s ability to make payments is at issue, the ECOA requires evidence that steps were taken to require reapplication, change the terms, or simply terminate the account.

In addition to general account disclosures, periodic statements are also required. TILA and RESPA require specific information be included, such as the unpaid principal balance and minimum payment and index information. To produce accurate periodic statements, servicing systems need to correctly calculate finance charges, apply payments, and track draws. Thus, processes must be established to ensure that contract terms are accurately recorded and billing errors corrected.

Along with TILA, RESPA, and ECOA, the FDPA also carves out regulations for HELOCs. Depending on the location, the FDPA requires that HELOCs maintain sufficient insurance coverage and that borrowers be notified of such requirements. For example, lenders must set policy to require coverage at the credit line amount or include a regular review of draws to ensure that coverage is sufficient to cover the outstanding balance.

Similarly, given that HELOCs may be subject to the FDPA’s mandatory purchase requirements and that only one National Flood Insurance Program (NFIP) policy can be issued per property, lenders should not be requesting a new policy when a policy already exists. Rather, borrowers should be instructed to notify their policy holder of their intention to obtain a HELOC, obtain proof of the policy, and confirm that the amount of insurance covers all loan amounts.

Update Your HELOC Tests

It is important that organizations understand the differences between mortgages and HELOCs to ensure efficient and effective testing of all processes and controls. While robust mortgage testing processes safeguard lenders and protect consumers, a specific testing process tailored for HELOCs will only strengthen those protections and reduce the likelihood of failing an examination or audit.

Now is the time to review controls and tests currently in place to ensure that both are in line with current HELOC regulations. Tests should be revised accordingly once the controls are updated, and questions refined where necessary. Moreover, sampling should be reviewed to ensure that samples are rational for the given production levels, HELOC regulations, product types, and terms in the given institution’s documents.

Conclusion

Even though HELOC originations languished between 2007 and 2021, many HELOC regulations have changed during this time. Today, there is no denying the growth in HELOC originations. In the second quarter of 2022 alone, lenders originated more than 807,000 new HELOCs.4 With such a significant rise in HELOCs, and increase in their regulation, there is a serious need to update HELOC testing to adequately reflect the higher production numbers and new rules.

1 Consumer Financial Protection Bureau: “Mortgage Financing Options in a Higher Interest Rate Environment,” https://www.consumerfinance.gov/about-us/blog/mortgage-financing-options-in-a-higher-interest-rate-environment/

2 While HELOCs are generally viewed as a second mortgage, they can be the first lien on a property if the borrower owns the property outright.

3 Closed-end credit is a debt instrument acquired for a specific purpose with a set amount of time, where funds are dispersed in full once the loan closes and the borrower makes fixed payments during the life of the loan. Open-end credit, however, is not restricted to a specific purpose and borrowers are able to draw up to their available credit line. During the draw period, payments are minimal with borrowers typically making interest-only payments. Once that period ends, the HELOC closes and the balance of the loan is repaid, either in full or over a fixed period of time. Borrowers are able to choose the amount they borrow, and conversely lenders can reduce the amount borrowers are permitted to draw based on specific conditions.

4 USA Today “Home Equity Line of Credit and Home Equity Loans: Right Tool at the Right Time,” https://www.usatoday.com/story/money/2022/11/10/home-equity-line-credit-applications-surged/7999537001/