If you cast your mind back to the beginning of 2023, you will remember that companies and the equity markets were striking an optimistic tone. The banking sector appeared to be transitioning to a higher interest rate environment in a responsible manner, and commentators were forecasting a soft landing for the U.S. economy.

Then came March 2023 and the failure in the U.S. of Credit Suisse, Silicon Valley Bank (SVB), Signature Bank, and First Republic Bank. The tide turned, and the very business model of banking came under challenge due to bad management and a disregard for managing risk.

Now, new U.S. regulations will likely lead to higher capital requirements for all banks holding above $100 billion or more in assets. Banks below $100 billion will be under increased scrutiny during regulatory examination to ensure senior management owns and is accountable for risks taken in pursuit of profits. Moreover, stress testing for adequate capital reserves and a focus on the underlying modeling assumptions has become a top risk management priority for all banks as regulators have increased examination and review due diligence.

Regulation On the Way

Facing investors rattled by these bank failures and fresh scrutiny of the Federal Reserve’s supervisory powers, Federal Reserve Vice Chair for Supervision Michael Barr recently raised the possibility of increasing U.S. banks’ capital requirements by as much as 20 percent. Barr shared this level as part of his plan to speed up the Fed’s supervision process and modify how banks are evaluated for resilience during crises. New rules are currently being drafted and are expected in the fall of 2023.

As we have seen before, higher capital requirements also come with a downside: Many U.S. politicians believe that if banks have to set more money aside as a safety net, they will not be able to lend as much, which could result in a slowdown of the U.S. economy. Addressing congressional concerns over proposals to tighten the reins on banks, Federal Reserve Chair Jerome Powell has conceded that, “More capital means more stable banks and stronger banks, but there’s also a trade-off there.” But he told Congress that the idea behind making banks put more money in reserve is to help them to stay solvent and to keep lending, no matter if the economy is doing well or poorly. He added that when banks fail in hard times, it makes lending even tighter and can lower the country’s overall economic output.

While bad management was a large reason for recent bank collapses, current capital requirements also played a role, Powell said. According to the Federal Reserve’s postmortem report on the SVB failure, bank senior leadership failed to manage basic interest rate and liquidity risk. The panic that led to the run on SVB stemmed from losses on the sale of securities that had gone down in value since the Fed started hiking rates. On March 8, 2023, SVB announced a balance sheet restructuring that included the sale of certain securities and an intention to raise capital. Deposit outflows were over $40 billion on March 9, 2023 and management expected $100 billion more the next day. SVB also was unable to monetize its held-to-market securities, which was in part why SVB repeatedly failed its internal liquidity stress tests. While higher supervisory and regulatory capital and liquidity requirements may not have prevented the bank’s failure, they would likely have increased SVB’s chances of survival.

Now, instead of just testing how banks would hold up in hypothetical scenarios, Barr has proposed a “reverse stress test,” where regulators would attempt to identify which factors and risks it would take to cause a bank to fail. Moreover, there needs to be an increased burden of proof on supervisors, and steps to ensure that supervisory actions provided banks with appropriate due process. The Federal Reserve Board of Governors would need to approve these changes before they could be enacted. We have to remember that what happens in the U.S. to large financial institutions has far-reaching impacts further afield as there are many foreign bank branches in the U.S. and foreign companies investing in its’ open economy.

It was only in 2018 that banks with $100 billion to $250 billion in assets—which included all three failed U.S. banks—were freed from some requirements under legislation passed by the U.S. Congress and rules issued by the Federal Reserve Board of Governors. So, Chair Powell has recently faced significant and harsh pushback from Republicans during recent House and Senate hearings over the potential for tighter capital rules. “The bank runs and failures in 2023 … were painful reminders that we cannot predict all of the stresses that will inevitably come with time and chance,” Powell explained. “We therefore must not grow complacent about the financial system’s resilience.”

And, as we have observed this year, confidence in the viability and credibility of a bank’s business model is crucial for its stakeholders and for the financial markets. But at SVB, despite repeated identified weaknesses in risk management from 2017 to 2021, the banks’ regulators did not downgrade the bank’s rating until August 2022. Once a bank’s credibility or reputation is damaged, there is only so much that healthy capital and liquidity ratios can do to save it.

Banks should start to plan for a big risk management challenge in the coming years. Senior management should approach the challenge with a strong clarity of purpose and a dose of humility, along with transparent communication with their board risk committees and prudential regulators to ensure risk oversight and bank safety is addressing the changing business conditions, new activities or products pursued, accelerated growth, enhanced capital buffers, and increasing business model complexity.

2023 Stress Test Results

In a related development in June, the Federal Reserve released the results of the 2023 annual stress tests conducted on the 23 largest U.S. banks. The stress tests[1] are closely watched by the equity markets because they typically determine how much money banks should be holding for hard times, as well as having an impact on stock buybacks and annual stock dividends.

The tests were first introduced in the wake of the global financial crisis of 2008 to ensure the resilience of the U.S. banking system. The results are meant to be educational to bank senior management and regulators, such as helping the Federal Reserve Board of Governors determine whether to bolster future tests by applying multiple scenarios to banks to capture a wider array of risks being faced. The 2023 stress tests are designed to determine if the nation’s 23 largest banks can withstand a severe global recession with heightened stress in both commercial and residential real estate markets, as well as in corporate debt markets. This year’s results are particularly significant, following the recent bank failures.

Under this year’s scenario, the unemployment rate rose by 6.5 percentage points over the course of two years, a steeper rise compared to the previous test of 5.8 percentage points. Home prices were set to decline more sharply, by 38 percent versus the previous year’s decline of 28.5 percent. This year’s test also emphasized potential commercial real estate issues, forecasting that large banks would continue lending despite experiencing heavy losses in a hypothetical downturn scenario. Commercial real estate, a growing concern for U.S. banks, was assumed to plunge by 40 percent in prices.

The results of its annual 2023 bank stress test demonstrated that the large banks are well-positioned to weather a severe recession and continue to lend to households and businesses even during a severe recession. All 23 banks tested remained above their minimum capital requirements during the hypothetical recession, despite total projected losses of $541 billion. Under stress, the aggregate common equity risk-based capital ratio—which provides a cushion against losses—is projected to decline by 2.3 percentage points to a minimum of 10.1 percent. The aggregate 2.3 percentage point decline in capital is slightly less than the 2.7 percentage point decline from last year’s test but is comparable to declines projected from the stress test in recent years. While the decline in the aggregate capital ratio was smaller this year than last, the results vary significantly across different types of banks.

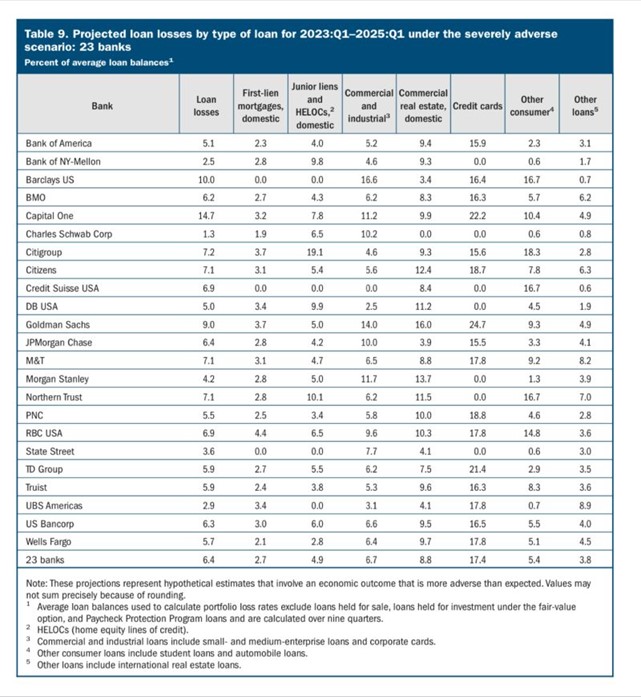

The business models of the 23 banks tested clearly drive the stress test results. The non-loan-focused banks (e.g., Bank of New York Mellon, State Street, Northern Trust, and Charles Schwab) all suffer loan losses that are not as significant as the other banks in the annual stress test. The capital of these institutions actually improves from the 2022 common equity tier 1 (CET1) ratio. Taking a closer look at Table 9 (below) from the Fed’s 2023 stress test results, there is a wide disparity of projected loan loss exposures across banks and wide deviations of results within specific loan portfolios.

Capital One, Citizens Financial Group, and Truist Financial witnessed the most negative impact from the annual stress test and will most likely be required to hold more capital. For example, JPMorgan Chase downgraded Citizens Financial and estimated its CET1 would increase to 8.6 percent. This demonstrates the need to stress the banks differently based on their unique portfolio characteristics and the complexity of their business models. This insight was not the purpose of these exercises but is important to note.

In the pre-release statement earlier this year, the Federal Reserve said the 2023 test were to include a new “exploratory market shock” for the eight largest banks participating, which will not affect their capital requirements but will further detail their resilience, as well as helping the Federal Reserve Board of Governors decide whether it should pursue multiple test scenarios in future years. The 2023 exploratory market shock focused on trading activities at eight of the 23 banks. The exploratory market shock test was characterized by a recession with inflationary pressures induced by higher inflation expectations. The Bank of New York Mellon and State Street were only required to incorporate an additional counterparty default component into their exploratory market shock component. The results showed that the largest banks’ trading books were resilient to the rising rate environment tested.

Source: Federal Reserve

Balance Sheet Composition

Since stress testing was introduced post-crisis alongside stronger risk management requirements from the global Basel Committee on Banking Supervision,[2] it has become particularly important for assessing the availability of capital and liquidity. Dodd-Frank Act Stress Tests (DFAST) and Comprehensive Capital Analysis and Review (CCAR) provide an assessment of a healthy bank in the U.S.

As a now-common component of banks’ risk management programs, a stress test requires defining a scenario, configuring the framework, and inputting the data. The outcome of the test is viewed in terms of banks’ balance sheets, capital adequacy, and need for recapitalization, as well as various financial soundness indicators (FSIs), including the risk contributions of operating income serving as a first buffer against losses, credit losses, and trading and investment losses.

Yet SVB’s high level of uninsured deposits and other risk exposures failed to raise red flags with the banks’ regulators, even with these post-crisis measures in place and despite reportedly widespread knowledge of the bank’s situation. In his closely watched annual letter to shareholders, JPMorgan Chase CEO Jamie Dimon said that “… interest rate exposure, the fair value of held-to-maturity (HTM) portfolios, and the amount of SVB’s uninsured deposits were always known—both to regulators and the marketplace.”

Compounding these risks, according to Columbia Business School Professor Tomasz Piskorski, is that “A good number of banks in the U.S. are at the mercy of their depositors. They are still vulnerable to selling assets at a loss. There is a path of exiting this, but it’s a very tricky path.” About 1,600 banks would fail if all $9 trillion of uninsured deposits were withdrawn from the U.S. banking system, Piskorski said. If half that money was pulled out, about 186 banks would fail, according to research cited by Piskorski. Additionally, Piskorski said that dozens of U.S. banks would have failed if the Federal Reserve and Federal Deposit Insurance Corp. (FDIC) had not acted in March and April to back uninsured deposits and rescue the ailing banks that failed.

Moreover, U.S. regional banks face fundamental liquidity problems, including a lack of capital to cover uninsured deposits as well as concentrations in leveraged loan portfolios. The high leverage by U.S. regional banks makes these lending institutions more vulnerable to the two-pronged risk of withdrawals by uninsured depositors and the reduced value of their securities portfolios. Rising deposit betas also impact interest rate risk as deposit duration shortens, affecting banks’ economic value of equity and the matching of funding to longer-term assets.

According to a research paper co-written by Piskorski and three other professors, the value of bank assets is about $2 trillion lower than suggested by their book value of assets accounting for loan portfolios held to maturity, and about half of U.S. banks now have a current value of assets that is less than the face value of their liabilities.

Midsize Bank Impact

Midsize banks of all asset sizes should brace for impending change. FDIC Chair Martin Gruenberg said it’s possible that SVB may not have failed if it fell under Basel III rules applicable to banks with over $250 billion or more in assets. Gruenberg also noted that the SVB collapse showed that banks of $100 billion to $250 billion of assets “can pose genuine financial stability risks, and the federal banking agencies need to review carefully the supervision of these institutions, particularly for interest rate risk in the current environment, and the prudential requirements that apply to them, including capital, liquidity, and loss absorbing resources for resolution.”

Midsize bank business models and balance sheets can vary significantly from those of the larger banks subject to regulatory stress testing. Midsize banks often have greater concentrations in commercial real estate and some other portfolios than their larger bank peers; the 23 large banks stress tested by the Fed hold about 20 percent of the commercial real estate in the U.S.

Stress testing at midsize banks can produce even more sensitivity to loan loss exposure when highly concentrated within loan categories, like commercial real estate, and in geographic regions. Whether it’s required or not, midsize banks are well served to perform rigorous stress testing of their portfolios and ensure loan loss reserve adequacy as well as have reviews performed to ensure capital levels remain sound through adverse economic cycles.

Yet many midsize and small banks suffer from a lack of flexibility in their stress testing. Indeed, many smaller banks’ stress testing models are simply Microsoft Excel spreadsheets or managed by third parties that do not understand the complexity of the bank. An ability to apply tailored portfolio and customer-specific scenarios at a more granular level can significantly assist both the risk management and strategic decision-making processes at these banks, while enhancing and adding to the robust understanding and value of risk appetite and limit setting.

Conclusion

Big banks this year held up to a hypothetical “severe” global recession, in the Fed’s stress tests of the 23 largest. But what about midsize banks and real-world risks?

Midsize banks are seeking to recover from the deposit crisis and loss of market confidence earlier this year. In fact, the current market stressors and the events of March 2023 have led all banks to prioritize the development of more granular internal stress testing and reverse stress testing as they understand the impact of low-yielding assets on their business model. Looking ahead, upcoming regulations are expected to increase capital requirements for all banks with $100 billion or more in assets. In response, banks are seeking means to deal with increased capital requirements by shedding assets, increasing deposits from core customers, reducing concentration risk, and merging with rivals to shed low-yielding assets as part of the combination.

Bank senior management and the board need to ensure that they are responsive by focusing on their net interest income as rates move and that both the independent risk management and internal audit functions provide effective challenge and oversight. This oversight should focus on deposits inflows and outflows, interest rate hedges, data inputs and assumptions validation, model risk governance, sensitivity analysis, timely reporting, and ability to demonstrate that appropriate controls are in place to meet supervisory expectations.

Like big banks, midsize and smaller banks will need to step up to the new market realities and heightening regulatory pressures despite their resource challenges and other disadvantages relative to their larger peers.

How Can Treliant Help?Treliant has extensive experience in building robust stress testing capabilities and response plans to stress test results. Specifically, Treliant can:

|

[1] U.S. bank holding companies, covered savings and loan holding companies, and intermediate holding companies of foreign banking organizations with $100 billion or more in assets are subject to the Federal Reserve Board’s supervisory stress test rules (12 C.F.R. pt. 238, subpt. O; 12 C.F.R. pt. 252, subpt. E) and capital planning requirements (12 C.F.R. § 225.8; 12 C.F.R. pt. 238, subpt S).

[2] Basel III is a comprehensive set of reform measures developed by the Basel Committee on Banking Supervision to strengthen the regulation, supervision, and risk management of the banking sector. The measures include both liquidity and capital reforms.