Tracing the journey from the past to the present

If we trace back the regulatory efforts to streamline the global OTC derivatives markets, it is worth mentioning that the Federal Reserve Bank of New York called a meeting of top Wall Street firms back in 2005 to discuss practices in the booming yet opaque credit derivatives market. Timothy Geithner, the then-president of the Federal Reserve Bank of New York, sent a letter to the 14 leading dealer banks, including JPMorgan, Goldman Sachs, Deutsche Bank, and Morgan Stanley, to discuss a range of issues in the credit derivatives market, particularly issues tied to the processing of these trades. The meeting was significant as it was conducted against a backdrop of concern that the largest banks might be caught on the wrong side of credit derivative bets.

The issue became even more prominent when General Motors’ credit rating was cut to junk status, which led to a sharp fall in the prices of General Motors bonds. In July 2005, a report by the Counterparty Risk Management Policy Group entitled “Toward Greater Financial Stability” highlighted the limited experience of the financial services sector in settling a large number of transactions, particularly in situations involving significant credit events such as corporate defaults or bankruptcy.

Fast forward to the 2008 global financial crisis, and this has undoubtedly been instrumental in prompting a concerted and coordinated response from the international community of banks, financial institutions, regulators, and supervisory agencies. The default of Lehman Brothers in 2008 provided an insight into the inherent risks underlying the functioning of the OTC derivatives market and strengthened the case of central clearing. At that time, the London Clearing House (LCH) liquidated more than 60,000 trades, representing more than $8 trillion of notional value. Trades cleared by the two largest clearing houses, LCH and Intercontinental Exchange (ICE), were almost entirely dealer-to-dealer trades. An explanation of the OTC derivatives business is not complete without considering dealer-to-client trades, and in the past, these were never cleared. Virtually all non-dealer businesses were executed by large institutions such as banks, investment managers, corporations hedging risk, and other similarly sophisticated market participants. The OTC derivative market microstructure in the pre-Dodd Frank era was largely dealt on a bi-lateral basis with significant credit risk exposures between counterparties.

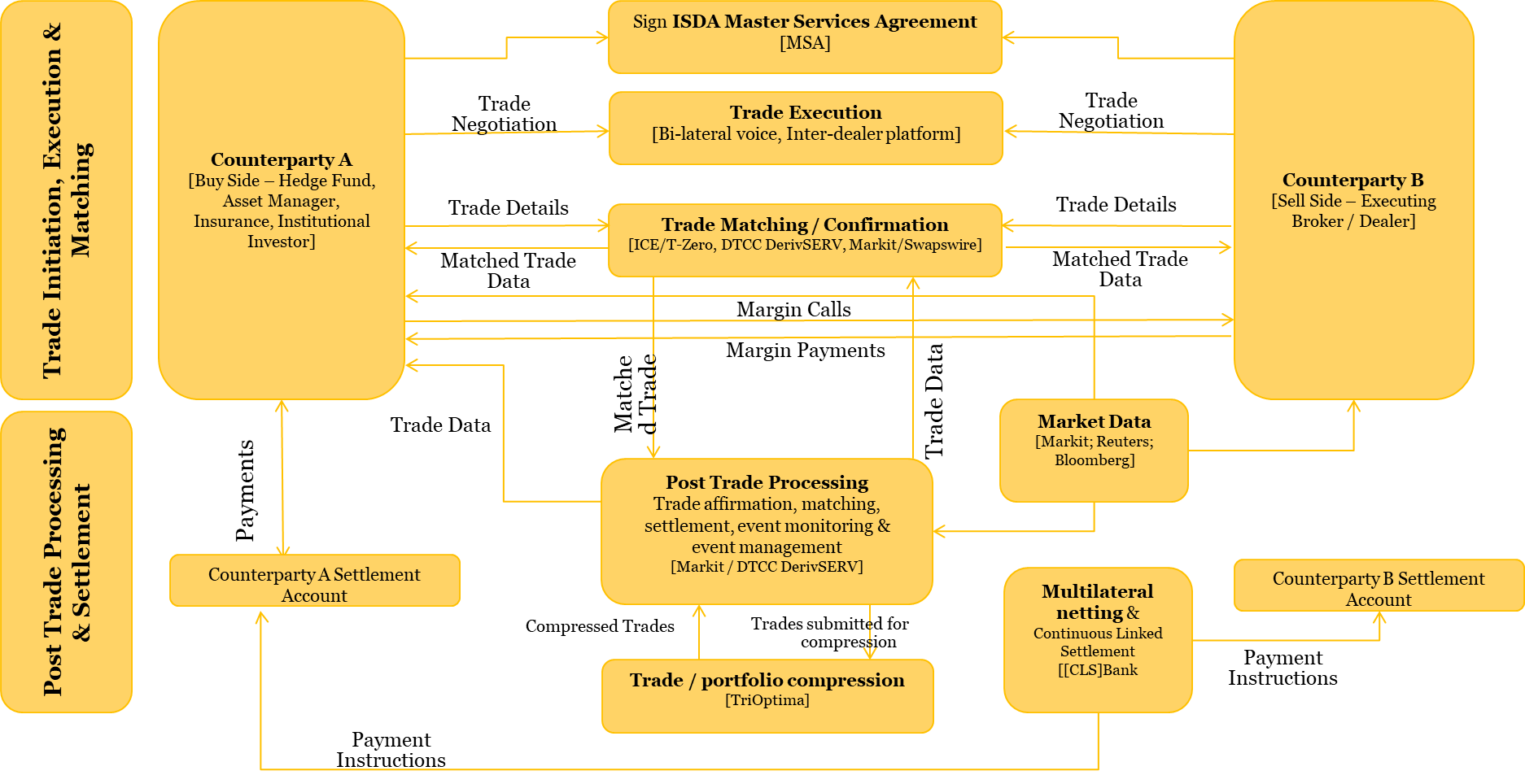

OTC Derivative Market Microstructure in the pre-Dodd Frank era

It then led to the Pittsburgh agreement in 2009, whereby G20 leaders expressed their commitment to strengthening and improving the functioning of the OTC derivatives markets. The agreement stated that all standardized OTC derivative contracts should be traded on exchanges or electronic trading platforms, where appropriate, and cleared through central counterparties by the end of 2012 at the latest. The underpinning principle behind the G20 commitment was to mitigate systemic risk and enhance transparency in otherwise opaque OTC derivatives markets

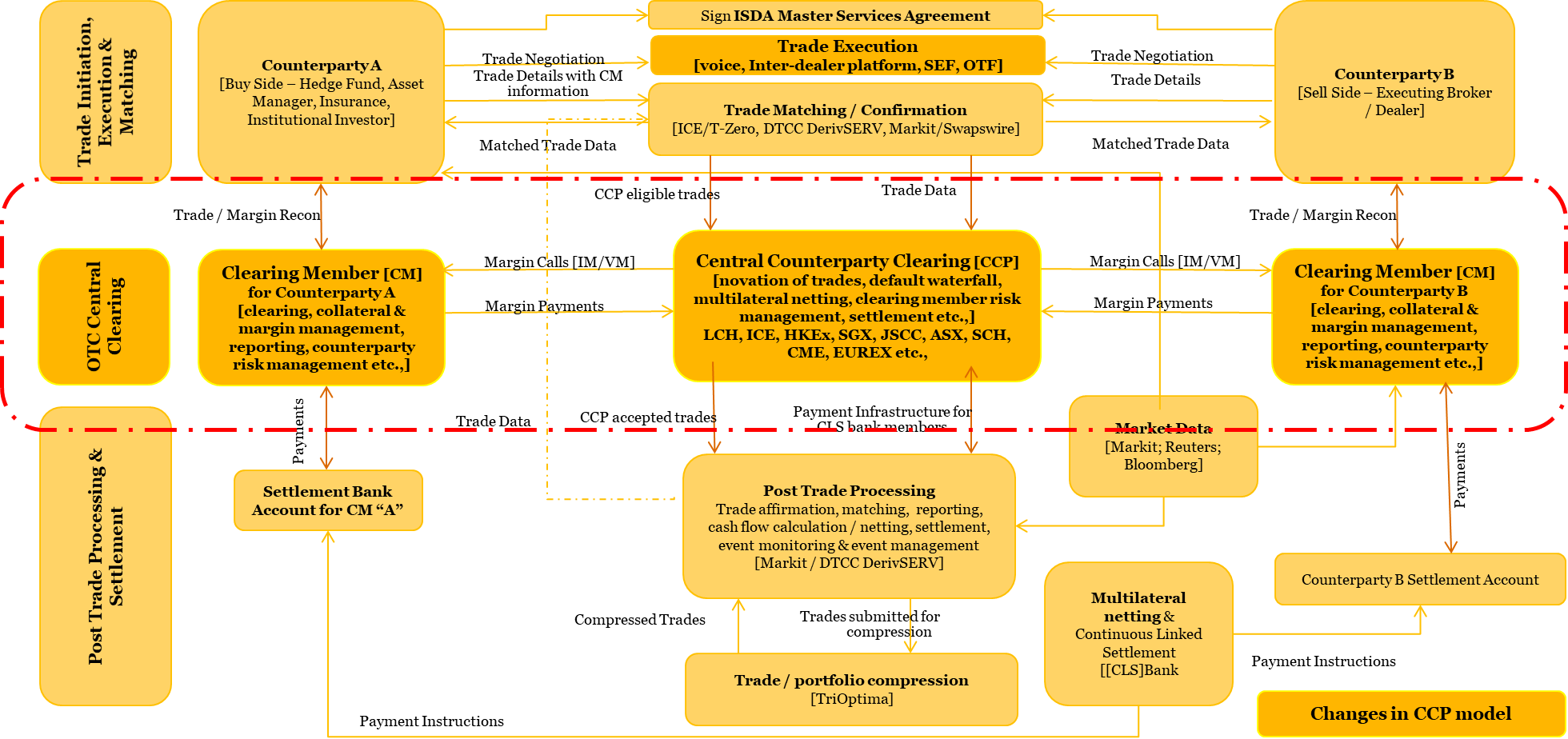

The Dodd-Frank Act subsequently initiated the process of legislating for the mandatory central clearing of standardized OTC derivative products. The OTC derivative market microstructure went through some fundamental changes in the post Dodd Frank era with the introduction of electronic execution, central clearing and reporting for standardized OTC derivative products.

OTC Derivative Market Microstructure in the post Dodd Frank era

For the non-standardized OTC products that did not qualify for central clearing, Basel Committee on Banking Supervision (BCBS) and IOSCO (International Organisation of Securities Commissions) mandated higher capital & margin requirements.

In line with the BCBS/IOSCO implementation timetable, the largest market participants had to comply with the margin rules from September 1, 2016. The variation margin (VM) requirements were extended to all covered entities from March 2017.

To mitigate regulatory compliance risks arising from the expanded number of in-scope entities for initial margin (IM) requirements, the BCBS and IOSCO announced changes to the implementation schedule on July 23, 2019.

Furthermore, in response to the COVID-19 global pandemic, the BCBS and IOSCO subsequently announced on April 3, 2020, that the final two phases of the IM requirements would be postponed for an additional year to September 2021 and September 2022, respectively. With this extension, the final implementation phase will take place on September 1, 2022, at which point covered entities with an aggregate average notional amount (AANA) of non-centrally cleared derivatives1 greater than €8 billion will be subject to the requirements. As an intermediate step, from September 1, 2021, covered entities with an AANA of non-centrally cleared derivatives greater than €50 billion are subject to the requirements.

What’s Next?

According to an ISDA analysis, lowering the AANA threshold from €750 billion to €8 billion would have increased the number of in-scope entities from about 60 to over 1,100, translating into approximately 9,500 counterparty relationships. Hence, the immediate priority for phase-6 firms is to determine if they are subject to the $8 bn AANA threshold.

The first critical step towards fulfilling the UMR obligations is to know if your firm exceeds the AANA threshold in order to plan for regulatory compliance and be operationally ready by Sept-2022.

Observation Period2 : AANA threshold > 8 billion (USD, EUR)

| UK / EU / Non-U.S. | U.S. Prudential | U.S. CFTC | Compliance Date |

| March, April, May 2022

Last business day of each month |

June, July, August 2021

Every business day in each month |

March, April, May 2022

Last business day in each month |

September 1, 2022 |

What to include for the AANA calculation3?

- Uncleared swaps

- Uncleared security-based swaps

- Deliverable FX swaps and

- Deliverable FX forwards

- FX swaps and deliverable FX forward even though they are exempt from calculating regulatory IM

What to exclude for the AANA calculation?

- OTC derivatives that are centrally cleared

- Exchange-traded derivatives

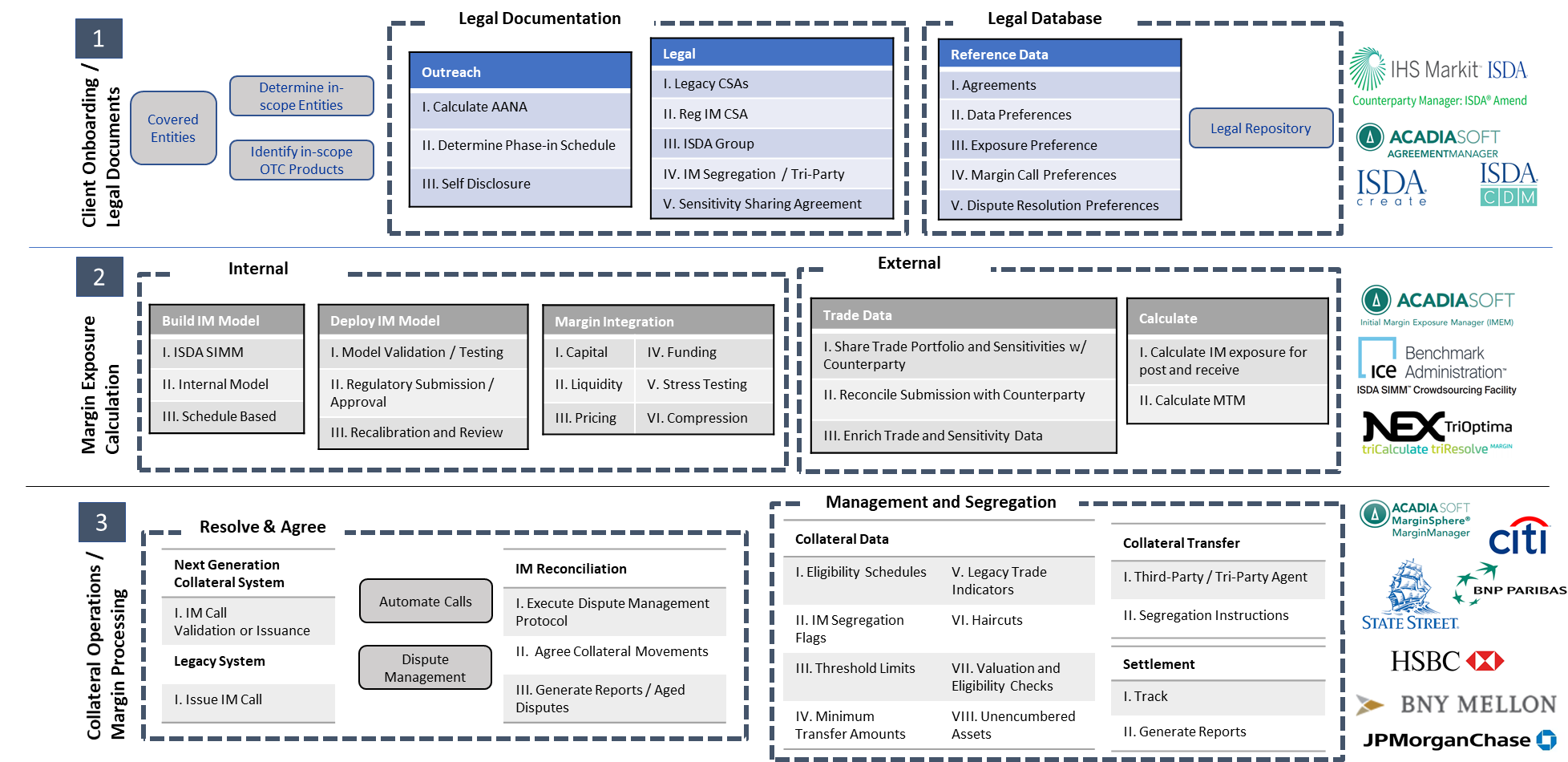

The journey to regulatory compliance and operational readiness for phase-6 firms is best achieved through a joint and collective effort involving multiple stakeholders from the business, operations, and technology divisions segmented across three broad areas:

- Client Onboarding / Legal Documentation

- Margin Exposure Calculation (i.e., initial and variation margin)

- Collateral Operations / Margin Processing

Key activities to be undertaken include:

Unlike Phase-1 to Phase-4 entities primarily comprised of sell-side firms, Phase-6 entities predominantly consist of buy-side firms presented with a significant opportunity to leverage the highly evolved industry utilities and vendor solutions to drive efficiency in their front-to-back collateral management infrastructure.

Long term implications of UMR compliance and the operational readiness journey

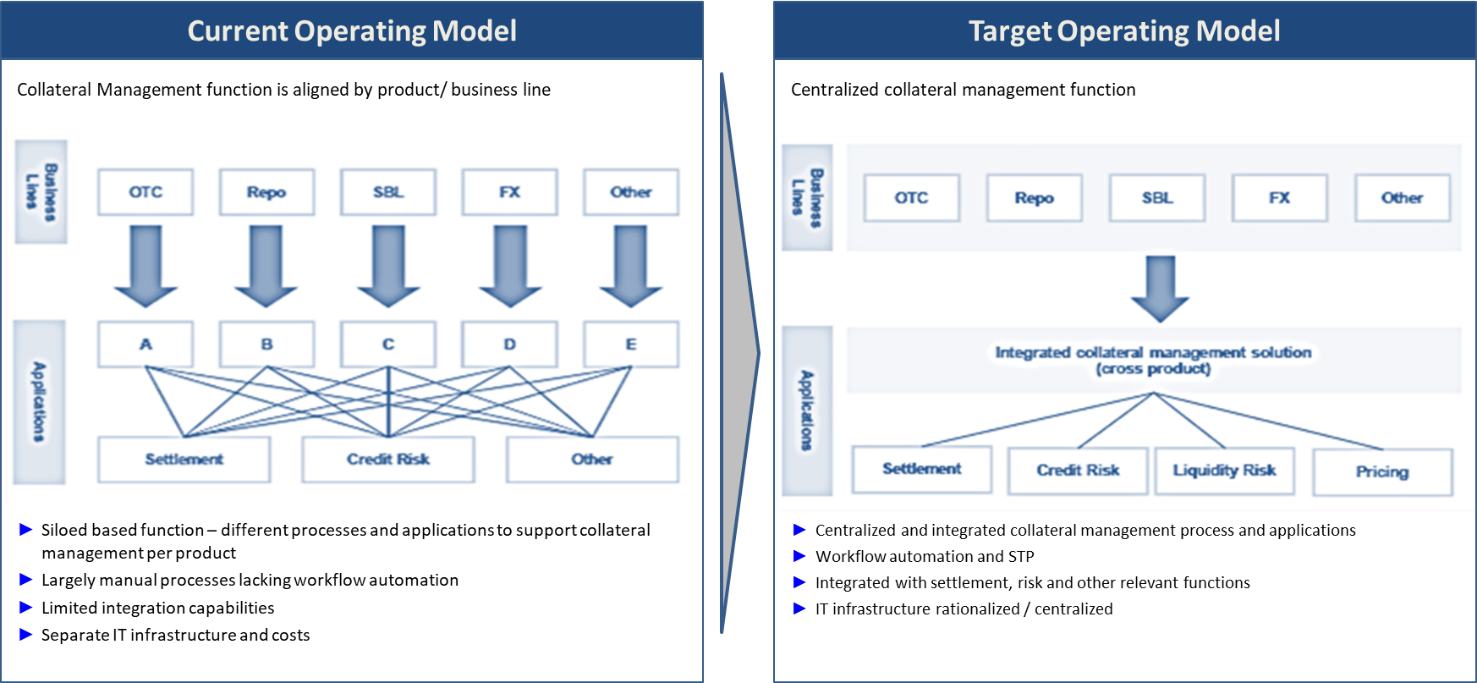

No more silos – Historically, collateral management has operated in silos across business lines, legal entities, and jurisdictions, with limited single-ownership for collateral across the firm. More than ever, there is now a perceived need for a more holistic and consistent view of collateral across the entire trade life cycle, risk management, and operations – across all lines of business, jurisdictions, and legal entities. There has also been ongoing dialogue with the custody and clearing banks on the need to provide an automated, real-time (intraday) view of the cash and collateral position of the firm. The industry is working on getting collateral operations involved “ex-ante” with front-office, legal, treasury, and risk management to ensure that collateral processes and agreements are operationally effective and incorporated into any pricing considerations. This allows for achieving economies of scale and harnessing cross-function opportunities such as collateral transformation and optimization.

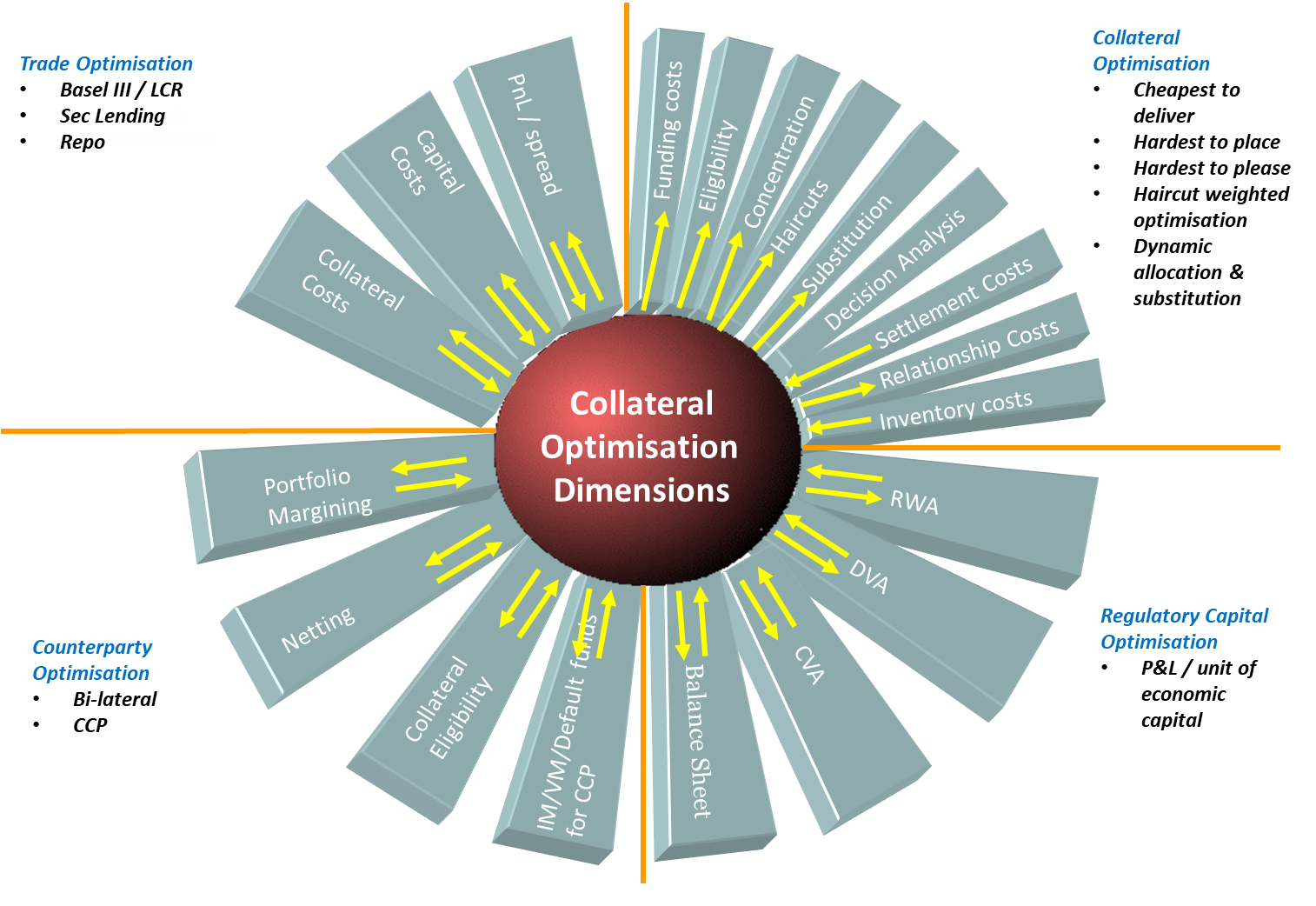

Collateral Optimization is a multi-dimensional problem – Collateral optimization enables efficient allocation of assets against regulatory, liquidity, risk, legal and operational constraints. Getting to such a solution requires a complete picture of the firm’s current practices and agreement on goals. More importantly, collateral optimization and the desired optimization outcome vary according to the business function.

The business/trading function aims to have greater control of collateral selection against trades with an intent to generate alpha through a rules engine that accounts for collateral costs, opportunity costs, and regulatory constraints.

From a buy-side perspective, the focus is pivoted around minimizing the demand for high-grade and additional collateral to realize the convergence of risk, liquidity, and collateral management through asset prioritization, transformation, and substitution.

The treasury function that acts as the gatekeeper of capital focuses on optimum use of collateral through scenario analysis that accounts for restrictions, haircuts, and limits.

Ultimately, the end-user is constantly looking to manage the collateral costs effectively through a consolidated view of the collateral long box by prioritizing available collateral, identifying the least universal collateral, and applying it to the most pressing needs. This is aided by the collateral tracking, substitution, and transformation service provider.

Front-to-back outsourcing takes center stage – The asset management industry is on the cusp of a tectonic shift as the multitude of global and regional regulatory developments and market developments coupled with the global pandemic present an incredible opportunity to streamline their front-to-back operations that would pave the way for increased bottom-line performance and higher operational resiliency.

The previous outsourcing trends in the asset management industry were driven mainly by the need to streamline the middle and back-office functions with little or no significant investments in the technology infrastructure. However, the current phase of asset management outsourcing is primarily driven by the need to move away from the siloed operations and outdated technology infrastructure towards a more seamlessly integrated front-to-back operational architecture. Asset managers are keen to align their middle and back-office functions with the front office enriched with high-quality data driving the performance analytics and reporting. The underpinning criteria driving the current wave of outsourcing decisions rests on the firm’s ability to have instant access to accurate and consistent data to gain deeper insights into the investment decision process.

Service providers who can deliver a fully integrated and interoperable platform encompassing a comprehensive and robust data management that aids the single source of truth are bound to have the edge over the competition in winning the outsourcing mandates. The demand for consistent data across the asset management investment flow value chain covering the front, middle and back-office functions, including portfolio modeling, order management, order execution, trade processing, reconciliation, fund accounting, safekeeping/custody of assets, and trade settlement, reporting is what drives the current outsourcing decision process unlike the previous waves of outsourcing. Ultimately, the quality and consistency of the data enable enhanced portfolio management and reduced compliance risk. This is precisely where securities service providers can play a significant role in easing the burden from the asset management community.

Phase-6 firms looking to select an outsourcing service provider to deal with the changing operational landscape of OTC derivatives should take a step back and make use of this opportunity to streamline the front-to-back operations. This will ensure that a single source of truth is retained from the inception of the trade to the final settlement.

1 – Full list of OTC derivative products subjected to initial and variation margin rules across multiple jurisdictions can be found here -> ISDA-In-Scope-Products-Chart_UnclearedMargin_In-process-6.10.21.pdf

2 – In the U.S., there are additional and separate margin rules published by the SEC for non-bank “security-based swap dealers,” which would be effective from November 1, 2021. The U.S. SEC margin rules vary in a few areas from the U.K. / EU and CFTC margin rules. https://www.sec.gov/rules/final/2019/34-86175.pdf

3 – Calculation is at the principal level; for example, pension funds must look across all their portfolios across asset managers