On April 9, 2024, the Senate Caucus on International Narcotics Control held a hearing on “Opaque Shell Companies: A Risk to National Security, Public Health, and Rule of Law” to examine the role of shell companies in facilitating the activities of transnational criminal organizations (TCOs). While the hearing focused on the trafficking of synthetic opioids and, more specifically, fentanyl, its implications extend to the broader need in the financial services industry for adequate controls to ensure the legitimacy of all customers.

The Senate hearing emphasized that opioid trafficking represents a clear and present threat to U.S. national security, as cited in the U.S. Treasury 2024 Money Laundering Threat Assessment (February 1, 2024), with over 108,000 U.S. fentanyl overdose deaths recorded in 2022. Testimony highlighted specific instances of bad actors using shell companies for operations (e.g., online pharmacies) and money laundering, as well as transnational drug trafficking cartels using registered U.S. aircraft to smuggle illegal drugs to the U.S.

Turning to detection and prevention, the hearing lauded the potentially transformative importance of the Financial Crimes Enforcement Network’s (FinCEN’s) recent establishment of Beneficial Ownership Information (BOI) reporting requirements and a supporting BOI registry / database to provide greater transparency into the ultimate ownership of U.S. legal entities for financial institutions and law enforcement. The proceeding also emphasized the importance of the Corporate Transparency Act of 2021 (CTA), which is intended to outlaw anonymous U.S. shell companies. Related testimony recalled past remarks by U.S. Secretary Treasury Janet Yellen that, “in the popular imagination, the money laundering capitals of the world are small countries with histories of loose and secretive financial laws … but there’s a good argument that, right now, the best place to hide and launder ill-gotten gains is actually the United States. And that’s because of the way we allow people to establish shell companies.”

Identifying Criminal Patterns

Transnational criminal drug trafficking globally was estimated to have resulted in $426 billion to $652 billion of value in 2017, according to analysis by Global Financial Integrity, with transnational trafficking organizations operating much like Fortune 500 companies. (In one example, a drug trafficking TCO allocated operational and money laundering responsibilities for money pick-up and transfer to fentanyl refineries and chemical brokers using prepaid envelopes with tracking numbers, bulk cash smuggling, and gold purchases.) Typically, the enforcement focus is on attacking the distribution network, but cartels are also supported by extensive precursor chemical supply chains and enabler networks; these leverage both U.S. and non-U.S. shell companies and their associated U.S. bank accounts to transfer revenue and expenses. During the hearing, testimony estimated that approximately 90% of law enforcement efforts are focused on the interdiction of illegal drug distribution, with only 10% dedicated to related money laundering investigations. Law enforcement drug-related financial investigations often identify shell company structures utilizing straw persons, proxies, front companies, or registered LLCs with no identified natural person or legal entity physical presence.

The Senate hearing coincided with the release of the Government Accounting Office’s (GAO’s) study titled “Aircraft Registrations: Risks Remain from Efforts to Obscure Ownership Information” (April 9, 2024), which updated a preceding report, “FAA Needs to Better Prevent, Detect, and Respond to Fraud and Abuse Risks in Aircraft Registration” (March 2020). Both reports identified and updated progress made by the Federal Aviation Administration (FAA) on addressing weaknesses in U.S. aircraft registry such as ownership or sales facilitation by U.S. and non-U.S. shell corporations.

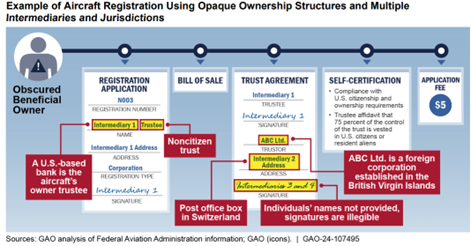

The GAO’s 2020 report analyzed FAA aircraft registry data to identify registrations with characteristics that matched one or more risk indicators, such as registrations using opaque ownership structures, corporations, and trust-based ownership that potentially disguised the beneficial owner, and registration addresses in countries identified by the U.S. Department of State as associated with major illicit drug production and money laundering, among other factors. A typical structure is illustrated below:

Within the registry process, a declaration of international operations should be viewed as representing heightened money laundering risk. The 2020 report identified aircraft registration process flaws and cited examples of U.S. planes used for illegal drug distribution with the U.S. tail number used to shield planes from scrutiny. The 2020 report found that a process for checking against the U.S. State Department terrorist watchlist could not be confirmed. The FAA also relied on the Office of Foreign Assets Control (OFAC) to share information on sanctions and did not check whether applicants and aircraft were subject to U.S. sanctions or blocking upon registration, at renewal, or on a periodic basis. Specifically, the FAA was not proactively obtaining and using OFAC data to detect (1) blocked aircraft, (2) entities or individuals subject to sanctions, or (3) those with potentially significant responsibilities for aircraft ownership, such as intermediaries registering on behalf of blocked aircraft or entities. Additionally, information on key aircraft parties was stored in .pdf format and was not captured electronically for automated list screening purposes. Per testimony, the FAA has offered that OFAC is not applicable to the aircraft owner and dealer registry, with this question left open-ended regarding the current FAA stance during the hearing.

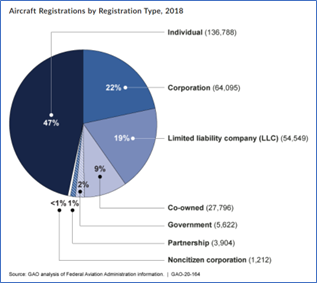

The chart below shows FAA aircraft registry entity types:

The report made 15 recommendations to enhance the FAA registration process, with only three foundational recommendations having been implemented as of the date of the hearing. An earlier FBI report characterized the FAA registration process as a “rubber stamp, rather than a watchdog,” with issues including the self-certification process, the limited information and supporting documentation collected, the manner of information storage (.pdf rather than electronic), and the low registration fee ($5). Testimony characterized “self-certification as tool for prosecution, not prevention.”

Financial Industry Implications

To reduce the use of opaque structures and ensure collection and maintenance of sufficient beneficial ownership information, testimony and further comments by Caucus Chair Sheldon Whitehouse and Ranking Member Chuck Grassley reiterated the need for a heightened focus on the expansion of requirements and ongoing integration of gatekeepers/enablers in the U.S. anti-money laundering (AML) regulatory regime. These include lawyers, accountants, financial advisors, brokers, notaries, trustees, registered agents, art dealers, and others in positions of authority to establish trusts and legal entities. Formation agents used to facilitate services such as bank accounts, “straw man” director names, and secretarial services were identified as of particular concern.

Additionally, to further support the emerging beneficial ownership regime, FinCEN has issued a Notice of Advanced Proposed Rulemaking for several sectors, including AML program and suspicious activity reporting (SAR) filing requirements for registered investment advisers and exempt reporting advisers (February 13, 2024) and persons involved in real estate closing and settlements (February 6, 2024). The real estate regulations would establish a real estate report that would identify the reporting person, the legal entity, or trust to which a residential property is transferred, the beneficial owners of that transferee entity or transferee trust, the person that transfers the residential property, and the property being transferred, along with certain transactional information about the transfer.

The Senate hearing also called for establishment of a Cross-Border Financial Crimes Center, enhancement of inter-agency investigation, and commitment of additional resources to the U.S. Treasury Department (FinCEN) and the U.S. Department of Justice to accomplish the DOJ’s Counter-Narcotics/TCO mission.

Among other takeaways, the hearing reinforced ongoing U.S. efforts to enhance its alignment with the global “FATF 40 Recommendations.” In March 2024, the Financial Action Task Force (FATF) released the “United States: 7th Follow-Up Report & Technical Compliance Re-Rating,” which states that the CTA “sets a clear federal standard for transparency and disclosure that is applicable to all reporting companies.” Along with citing progress in addressing other deficiencies, FATF has re-rated the U.S. as largely compliant (from non-compliant) on FATF Recommendation 24, which requires that countries ensure their competent authorities have access to adequate, accurate, and up-to-date information on the true owners of companies.

As a final sobering reminder of the critical importance of the CTA, according to a 2011 study by the Stolen Asset Recovery Initiative, a joint effort of the World Bank and United Nations Office on Drugs and Crime, anonymous companies were used to hide the proceeds of corruption in 70% of the grand corruption cases reviewed, with U.S. entities being the most common.

Conclusion

Along with bank and non-bank financial institutions, professionals involved in estate, tax, and financial planning, including estate lawyers, tax lawyers, CPAs, CFPs, CLUs, trust officers, and private bankers should establish and implement adequate controls to ensure the transparency of their clients’ legal entity structures. Emphasis must be placed on the collection, storage, and periodic and trigger-based review of information on legal entities’ beneficial owners and those in control, with robust customer identification programs (CIP), politically exposed person (PEP) reviews, negative news screening, network link analysis, and other due diligence to detect and prevent the disguised ownership of bad actors and the illicit flow of funds within the U.S financial system.