The European Banking Authority (EBA) has proposed changes affecting banks’ market risk modeling and maintenance of reserves against unexpected losses. The authority’s approach is to tighten the assessment methodology used by Europe’s national regulators when allowing individual banks to use their own risk models instead of a standard model framed by the Basel Committee on Banking Supervision. The EBA has asked the financial services industry to weigh in by late June on a consultation paper released in March.

Background

The Basel Committee created a regulatory framework known as the Fundamental Review of the Trading Book (FRTB) after the global financial crisis of 2008-2009 exposed weaknesses in existing market risk modelling. The rules were issued in 2016 and updated in 2019. Now, the EBA is proposing to adjust the regulatory technical standards (RTS) that Europe’s national regulators apply when banks propose using an internal model approach (IMA) rather than the standard model for calculating and reporting risk. Such models determine banks’ “own funds” requirements for holding equity and other reserves to cover market risk.

Certain banks prefer to use an IMA so they can tailor their risk management practices to their specific business activities and risk profiles. Other benefits are said to include better accuracy and, potentially, a reduction in the amount of reserves required. But regulators generally hold banks to a higher standard when they use an IMA.

What’s Changing

The EBA consultation paper effectively lays out a framework for banks to use in applying for and maintaining an IMA. In the paper, the IMA assessment to be used by regulators is segmented across three chapters:

- Governance of the market risk model, which includes the organizational structure, decision-making process, composition and role of senior management, independent review, adequacy of IT systems used to generate risk figures, position limit breaches, trading desk structure, stress testing, position limits, reporting, and other factors.

- Internal risk measurement model, covering the expected shortfall and stress scenario risk measures. The national regulator would focus on factors including:

- Risk factor set up, modeling of curves and surfaces, compliance with RTS on liquidity horizons, risk factor eligibility test

- Risk factor set up, modeling of curves and surfaces, compliance with RTS on liquidity horizons, risk factor eligibility test

- Treatment of foreign exchange and commodities in the banking book

- Data quality and proxies

- Backtesting and profit-and-loss attribution

- Calculation of the expected shortfall measure including the distribution of risk factors, correlation of risk factors, and number of simulations used when the model relies on the Monte Carlo statistical technique

- Calculation of the stress scenario risk measure

- The national regulator would subject banks to two types of assessment:

- Mandatory assessment methods that the regulator must apply regardless of the bank’s situation

- Optional assessment methods used by the regulator whenever the mandatory assessment methods are not sufficient, such as when banks have incomplete documentation or model validation weaknesses. The optional assessments would tend to be more intrusive and burdensome for both the regulator and the bank being examined.

- Internal default risk model: The regulator would look to determine if the bank is compliant with requirements regarding default probabilities and “loss given default” for the default risk model. A bank is expected to show how these determinations have been obtained, whether via an internal ratings-based approach or external sources. Details to be checked include the definition of default, techniques used to rescale a default probability to the applicable time horizon, and data used to estimate default probabilities and losses given default, among others.

The consultation paper invites responses to 50 questions across the three areas above, with comments due by June 26, 2023.

Notably, the consultation paper highlights risks arising from climate change and broader environmental issues. Therefore the draft would explicitly require national regulators to verify whether banks are considering those risks in their stress testing program for internal models.

Model Governance Considerations

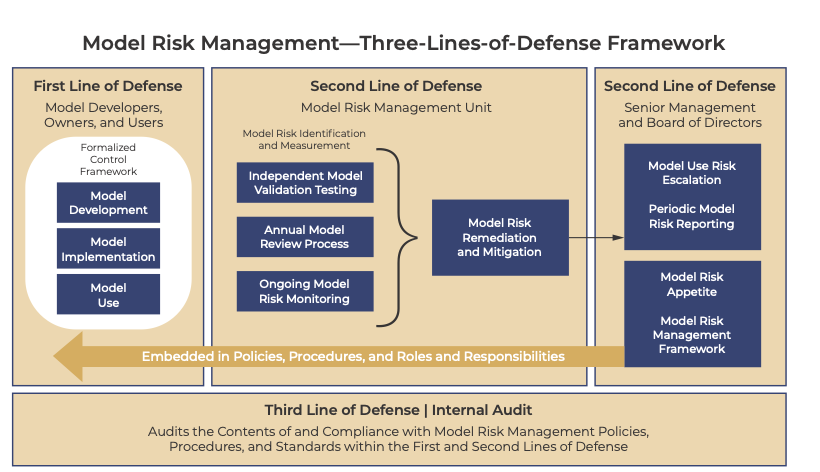

As banks go through the process of preparing themselves for FRTB IMA approval submissions to their regulators, it is recommended that they put in a place a robust model governance framework that seamlessly integrates the business line functions, risk management, and internal audit stakeholders across the three lines of defense.

It is worth connecting the dots between the EBA’s consultation paper and the Targeted Review of Internal Models (TRIM) exercise conducted by the European Central Bank, to bring a common understanding and consistency across capital models and reduce the variability of risk-weighted assets calculated using internal models.

Market risk model shortcomings observed by ECB examiners fall in these top three areas:

- Methodology in calculating the stressed value at risk (VaR) and “incremental default and migration risk charge” (IRC)

- Scope of the internal model approach

- Internal validation and backtesting

ECB TRIM assessments have detected several common issues in the three areas listed above, involving:

- Incomplete validation of risk factors

- Usage of pricing models for VaR and stressed VaR

- Actual and hypothetical backtesting

- Gaps in data quality and model documentation

The Takeaway

Post-pandemic bank failures certainly highlight the need for banks to strengthen their model risk management to mitigate model risk while enhancing the monitoring and ongoing performance of models. The areas that need most attention include analytics and reporting, model risk governance, model risk policies and standards, model inventory, model monitoring, and model lifecycle management. Notably, the list also includes the standardization of processes, which has always proven to be a challenge for banks.

How Treliant Can Help

Treliant provides end-to-end coverage of the Basel capital reforms. Our capital markets practitioners assist financial services companies in designing, building, and implementing all related elements of their business, regulatory, risk, and compliance framework.