The key to designing a robust FRTB implementation plan lies in having a firm grasp of the local rule-making process, says Kishore Ramakrishnan.

Just like COVID impacted your vacation plans, it also played a part in pushing the implementation of the Fundamental Review of the Trading Book (FRTB) regulations. But, as the complex regulatory framework nears global deadlines for full implementation, the challenges facing institutions are becoming clearer.

As the Basel Committee on Banking Supervision (BCBS) said when first issuing the guidance in 2013: “The financial crisis exposed material weaknesses in the overall design of the framework for capitalising trading activities.”

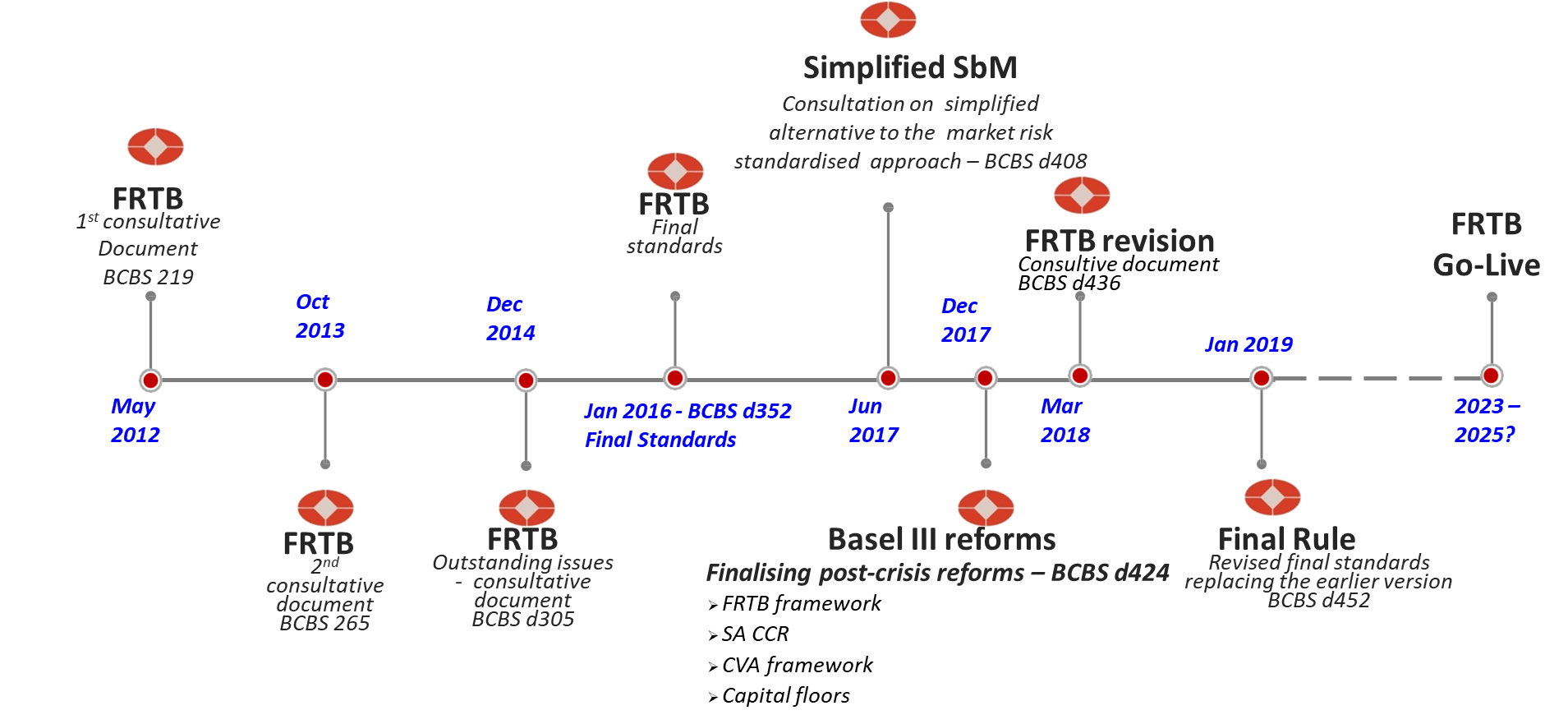

Evolution of the new market risk framework – FRTB Implementation Timelines

At its core, FRTB is designed to completely revise the approach for calculating risk-based capital requirements for trading activities. At the risk of oversimplifying, the FRTB regime has three fundamental purposes:

- To draw a clear line between banking and trading book activities by imposing additional tools for supervision while also addressing the treatment of credit risk in the trading book

- To introduce a risk-sensitive standardised approach to calculating the market risk RWA while also attempting to address the hedging and portfolio diversification issues in the traditional VaR approach

- To introduce a revised internal model method using a new risk measure, i.e., expected shortfall instead of VaR with particular emphasis on the modellable risk factors, to enhance the transparency and comparability of RWA while also addressing the liquidity issues in trading book positions

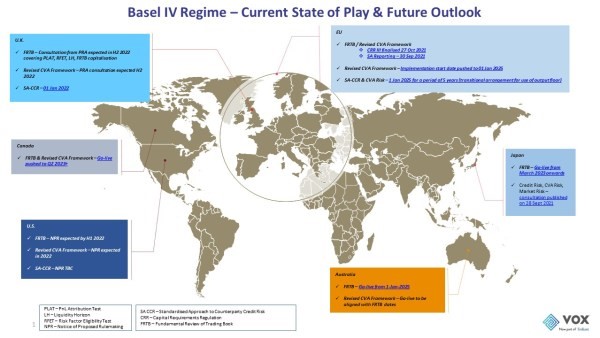

While the global standards have been finalised by the BCBS, individual national banking regulators are in the process of finalising the rules as they apply to their respective jurisdictions, with implementation timelines ranging from 2023 to 2025 and beyond.

Robust implementation plan

The key to designing a robust implementation plan lies in having a firm grasp of the FRTB regime’s regulatory rule-making process.

As banks navigate the multitude of regulatory implementation timelines, it is recommended to undertake a certain set of activities at each stage of the local rule-making process, in alignment with the national regulator’s approach to finalisation in their individual jurisdictions. This not only allows for banks to build a robust and comprehensive implementation plan; it also ensures the fulfillment of regulatory expectations at different stages of the rule-making process.

In line with the regulatory rulemaking process in individual jurisdictions, banks should be mindful of three key stages in the planning and implementation of FRTB:

- While regulators are in the process of finalising local implementation rules, banks should be focused on the following key areas:

- Conduct a detailed review of desk structures i.e., what constitutes a desk structure at each firm – SA, IMA candidates

- Identify the data sources used by internal risk systems

- Review approach to bucketing of sensitivities

- Review of trading / banking book boundaries

- Ensure readiness to provide information to regulators on decisions to adopt IMA

- Review choices on SA, IMA approaches

- Review RRAO (residual risk add-on) approaches in detail. This should not be treated as a one-time exercise; instead, banks should be prepared for multiple rounds of assessment from the regulator. The emphasis should be around checking for the consistency of capital calculations and avoiding large fluctuations in such calculations

- Conduct hypothetical portfolio reviews like the ISDA benchmarking exercise. During this stage of the rule making process, most regulators tend to initiate outreach with banks to identify sample portfolios and benchmark the results

- Once local rules are finalised, regulators will be focused on the following key areas:

- Implement any changes from the draft rules to final rule phase during this period

- Address all issues uncovered in hypothetical portfolio review exercises

- Examine models with particular attention on the conceptual soundness of internal models

- Examine the principles of modellability at the risk factor level. Regulators would also consider a checklist of principles for banks to apply

- Consider which principles will apply to which banks, based on data sets and models being submitted for review

- Examine the RFET and PnL attribution test results to ensure there is proper alignment of front office and risk pricing models for a particular desk and ensure proper backtesting takes place

- Conduct review at multiple levels, including the firm-wide level and individual trading desk level

- Subject banks to a range of high intensity reviews covering multiple aspects of FRTB

- Following the go-live phase, regulators and banks alike should be focused on the following key areas:

- Regulators will focus on the following aspects for each bank: IMA, RFET, backtesting – with the intention of carrying out quarterly assessments on desk level status (RAG)

- Banks and supervisors will assess decisions on whether bank models are acceptable or not, within a very short timeframe

- Regulators will expect the banks to be ready for thorough reviews of the data on a quarterly basis

The rules are complex, and implementation – let alone adherence to the regulations – will be a challenge for all players, as changes across data, analytics, risk, capital and treasury functions, technology and governance are necessary.

Big decisions

As banks undertake this multi-year journey of regulatory on-site examinations and model approval submissions, it is worth leveraging the lessons learnt from the ECB (European Central Bank) TRIM (targeted review of internal models) exercise.

Based on 200 on-site investigations conducted at over 65 significant banks during the exercise, the ECB found 5,800 deficiencies with the internal models across risk types, and issued 253 supervisory decisions requiring an overall increase of RWAs of about EUR 275 billion.

The most commonly noted gaps were related to incomplete validation of risk factors, data quality and model documentation, internal validation and internal backtesting, actual vs hypothetical back testing, and scope of coverage for internal model approach, among other deficiencies.

A fundamental shift in the market risk regulatory requirements entails the restructuring of the very infrastructure financial institutions have relied on for years. It is no easy task to make these kinds of changes, especially for banks that have not yet started implementation.

Where can an institution find the necessary personnel with the required expertise? Are there opportunities for in-house retraining, or is there a need to look externally? How will the changes be rolled out internally?

The fast-approaching deadline compels firms to make very big decisions far more quickly than they are used to. If FRTB is to succeed in shifting risk awareness, compliance and visibility in the way Basel intends, these questions need to be answered now.